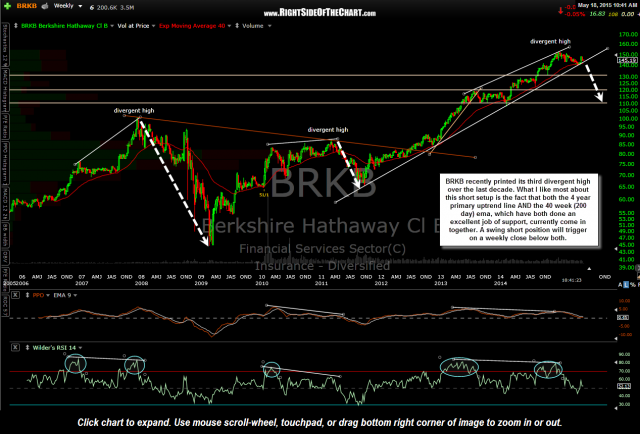

BRKB (Bershire Hathaway, class B) recently printed its third divergent high over the last decade, with the previous two immediately followed by corrections bear markets of 25% & 55%. What I like most about this short setup is the fact that both the 4 year primary uptrend line AND the 40 week (200 day) ema, which have both done an excellent job of support, currently come in together. A swing short position will trigger on a weekly close below both.

BRKB (aka BRK.b) is the largest component of XLF/FAS at a weighting of 8.70% with WFC a close second at 8.55% (and looking just a poised for a correction as BRKB IMO).

Also note in the twitter feed on the left side of the homepage of RSOTC that I have posted a potential short trade setup for WFC (Wells Fargo) which I may also add an an official trade idea soon. Before that, I had also tweeted out that I have taken a starter short position in FAS (3x leveraged bullish financials etf) earlier today.

My plan with the FAS short is to add to that position once I start to see several of the top holdings in XLF (BRKB, WFC, JPM, etc….), all of which look poised for a correction, start to break down below their respective uptrend lines & bearish technical formations.

As of now, the FAS short is an “unofficial” trade idea as most of the key financial stocks have yet to trigger an objective short entry (breakdown) and are still in confirmed uptrends for now.

As with the recent ERX (3x long energy) & CURE (3x long healthcare) short trades, my thoughts are that FAS has the potential to morph into a multi-month swing short trade and if so, that would provide not only the opportunity to profit from a correction in the financial sector but also to take advantage of the price decay inherent with these 3x leveraged etfs.

On an admin note, I’ll be leaving for a little R&R down in the Virgin Islands on Wednesday morning, returning Sunday. As such, I probably won’t be posting many, if any, updates or commentary on the site later this week although I will rely on the convenience of the twitter feed to post any relevant market developments as well as any stand-out trading opportunities that may arise. From what I’ve noticed, the twitter feed timeline embedded on the left side of the homepage seems to automatically update on my computer when using Internet Explorer but requires the page to be refreshed when using Chrome or Firefox. We’re looking into a resolution for that issue & I just wanted to make everyone aware that the twitter feed on the site may or may not automatically populate new tweets, depending on your browser and unique settings on your own computer. Also keep in mind that you are not required to create a twitter account to access the @RSOTC twitter feed directly from twitter.com.