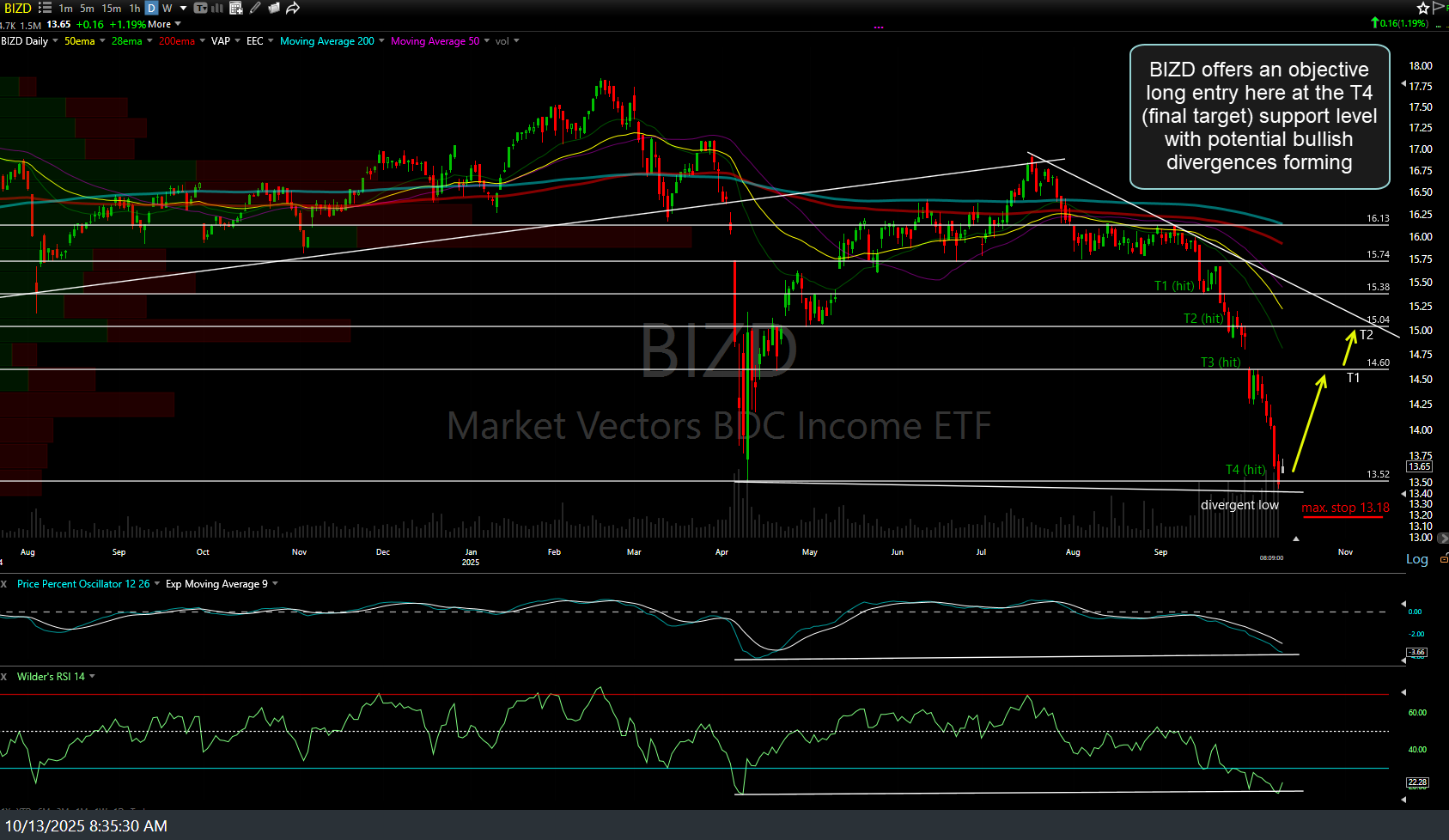

As I mentioned in Friday’s final video, I decided to take a starter position in BIZD (BDC Income ETF) when it hit my fourth & final price target at that time. With both BDC and the broad markets holding up in the pre-market session so far today, I am going to add BIZD as an official long trade idea as it still offers an objective long entry here at key support for both a pure-play long (especially those looking for a high-yielding, dividend-paying position) as well as a potential indirect hedge to a short positions on any of the major stock indices*. Daily chart with price targets & maximum suggested stop (if targeting T2) below.

*As I stated in recent videos, the logic behind taking BIZD, which has been in a death spiral lately, as an indirect hedge to a stock market short position is that, assuming the worst is over & there aren’t any additional repercussions or other trouble loans that suddenly pop up (following Tri-Color & First Brands sudden bankruptcy announcements), then the BDC’s are likely to stabilize & rally off this key support level. Should there be additional issues with the BDC’s continuing to fall, that would most likely start to spill over to worries (and selling) in the other areas of the financial sector (including banks) as well as the broad market.

My preference is to stick with the starter position I took on Friday until at least seeing how the broad market (and BIZD) trade today & maybe throughout this week, following Friday’s solid sell signals, before adding or taking BIZD to a full position.