Before I get into the intraday charts, which are much more useful for timing entries & exits on swing trade & quick pullback trades, let’s take a quick look at the bigger picture in the biotech sector. As this weekly charts illustrates, so far, the 2016 rally in IBB appears to be nothing more than a low-end counter-trend rally, with a mere 38.2% Fibonacci retracement of the move off the highs & the weekly PPO signal line (a fairly accurate trend indicator) still below the zero line, signaling that the primary trend has been bearish since shortly after the uptrend line break in 2015.

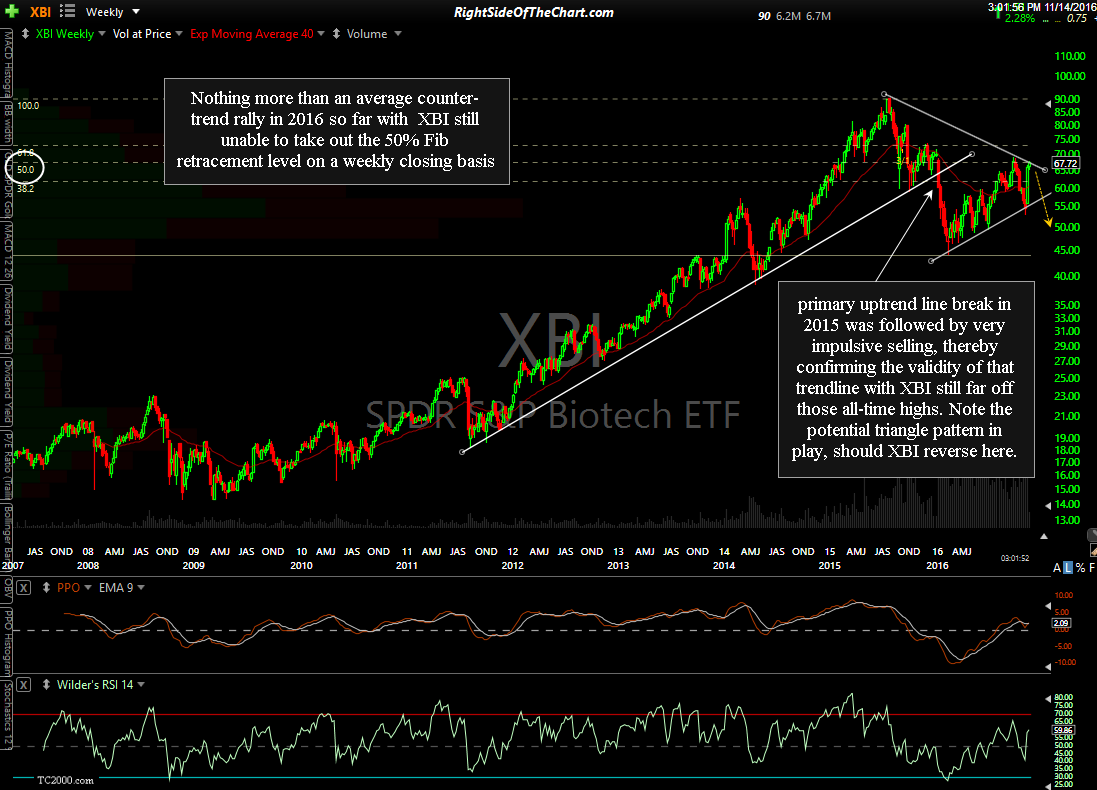

XBI has managed to move the PPO signal line back somewhat above the zero line with a bit stronger, yet still within the typical “counter-trend bounce” range of a 50% Fibonacci retracement of the move down from the 2015 all-time highs into the early 2016 lows. The primary uptrend line break in 2015 was followed by very impulsive selling, thereby confirming the validity of that trendline with XBI still far off those all-time highs. Note the potential triangle pattern in play, should XBI reverse here.

Hard to get a solid read on the next direction in IBB from the daily charts as I prefer to confirm trend changes with divergences, as these previous 4 divergent highs & lows that immediately preceded major corrections & the mid-2016 rally. However, IBB is approaching overbought readings while in the resistance zone (shaded area) that has acted as support & resistance for the last couple of years. XBI is also approaching the 69.00 resistance level while also approaching overbought readings on the daily RSI following a near-vertical rally.

- IBB daily Nov 14th

- XBI daily Nov 14th

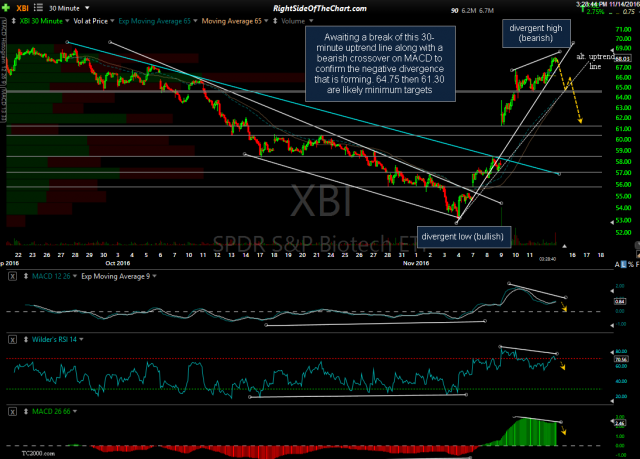

Zooming down to the intraday charts, while another slight thrust up above Thursday’s highs in IBB would help to put in a divergent high, whether that happens or not, a break below this uptrend line, assuming the divergence is still in place at the time, would likely bring IBB down to any or all of these horizontal support lines/targets (15-minute chart). On the XBI 30-minute chart, I’m waiting a break of this 30-minute uptrend line along with a bearish crossover on MACD to confirm the negative divergence that is forming. 64.75 then 61.30 are likely minimum targets.

- IBB 15-minute Nov 14th

- XBI 30-minute Nov 14th

These are not official trade ideas at this time although I may add either IBB, XBI & possibly LABU as official short trade ideas soon, either for a quick pullback trade that might only last a day or so & possible for a longer-term swing trade. I just wanted to share the charts & my thoughts in advance for those interested or currently trading the biotechs.