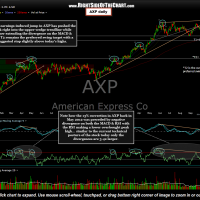

Today earnings-induced jump in AXP (American Express Co.) has pushed the stock right into the upper-wedge trendline while further extending the divergence on the MACD & RSI. T2 remains the preferred swing target with a suggested stop slightly above today’s highs. Note how the 13% correction in AXP back in May 2012 was preceded by negative divergence on both the MACD & RSI with the RSI making a lower overbought peak high… similar to the current technical posture of the stock today only the divergences are 3-4x larger. Updated daily chart.

Today earnings-induced jump in AXP (American Express Co.) has pushed the stock right into the upper-wedge trendline while further extending the divergence on the MACD & RSI. T2 remains the preferred swing target with a suggested stop slightly above today’s highs. Note how the 13% correction in AXP back in May 2012 was preceded by negative divergence on both the MACD & RSI with the RSI making a lower overbought peak high… similar to the current technical posture of the stock today only the divergences are 3-4x larger. Updated daily chart.