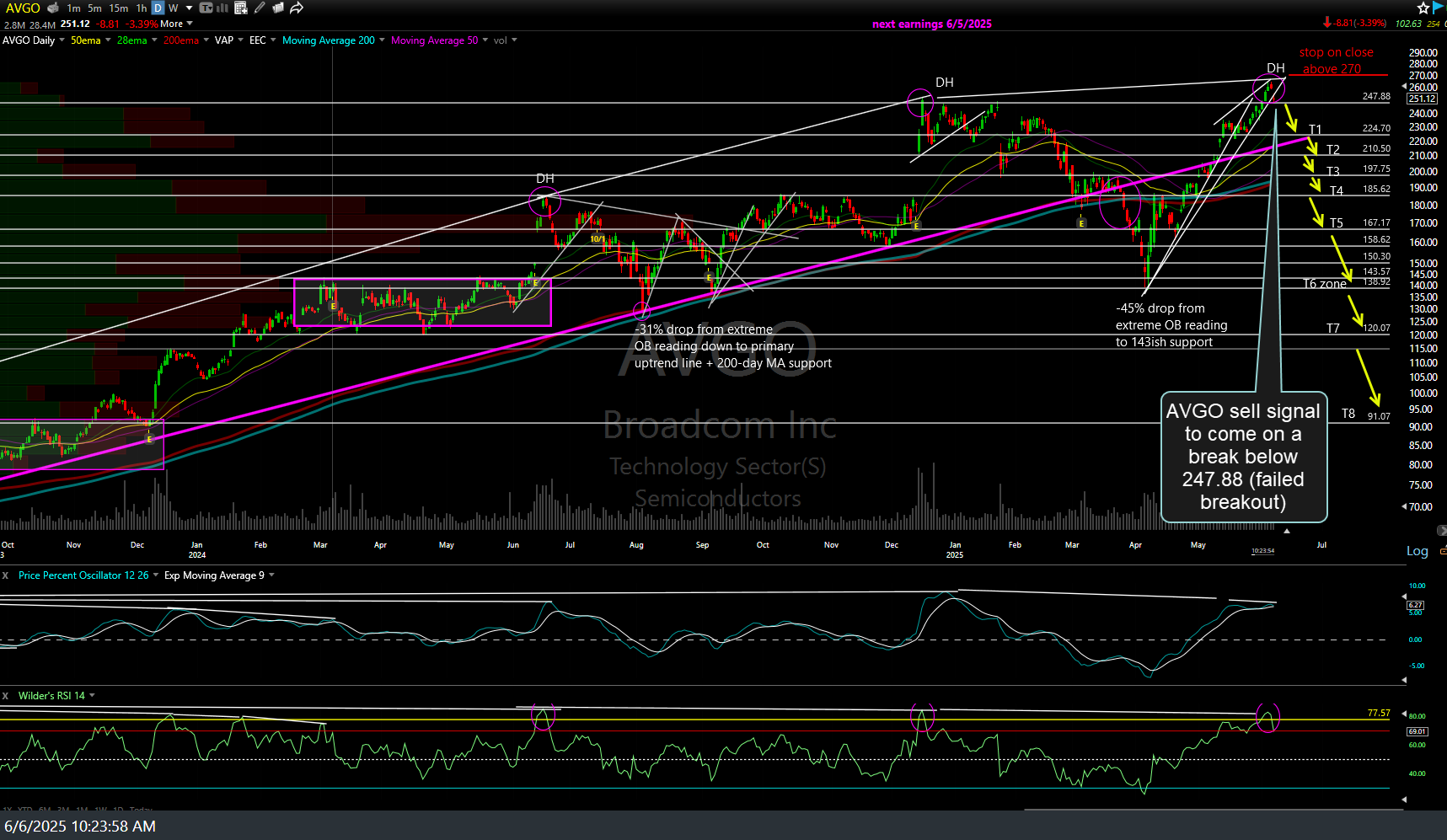

AVGO (Broadcom Inc.) will trigger a sell signal on a break below 247.88 (i.e., a failed breakout/bull trap). With a relatively tight suggested stop on a daily close above 270, this trade offers an excellent R/R of 7:1 to the final target (T8). Daily chart below.

Typical swing traders might opt for the initial targets, down to T3, which will likely coincide with a pullback to the 200-day moving averages should a short entry trigger soon, while trend traders might opt for the longer-term targets, with more active traders micro-managing (covering and/or reversing when the odds for a double-digit counter-trend bounce are high) along the way.