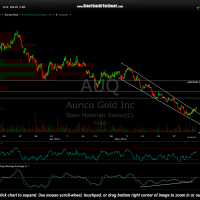

AUQ (Aurico Gold Inc) will be added directly as an Active Long Trade idea here around the 3.52 level. AUQ recently bounced off support on the daily chart following an extended downtrend. Zooming down to the 60 minute time frame, AUQ recently broke above this descending contraction channel/wedge type pattern, complete with bullish divergence in place on the MACD. Two current price targets, T1 at 3.68 & T2 at 3.81, are shown on the 60 minute chart with a possible third target around the 4.oo level, which may be added depending on how both AUQ & GDX trade going forward.

An alternative entry on this trade would be to wait for a confirmed breakout of the recently posted GDX 15 minute chart. That would be a 60 minute candlestick close above the 22.50 level. Although waiting for the additional confirmation of a GDX breakout might lead to a less favorable entry on AUQ, waiting for a breaking in the sector would increase the odds of the AUQ trade being successful. As I type, GDX is currently trading at 22.53 and has been pushing against the bottom of that thin zone (resistance) since gapping higher today.

- AUQ daily June 5th

- AUQ 60 minute June 5th