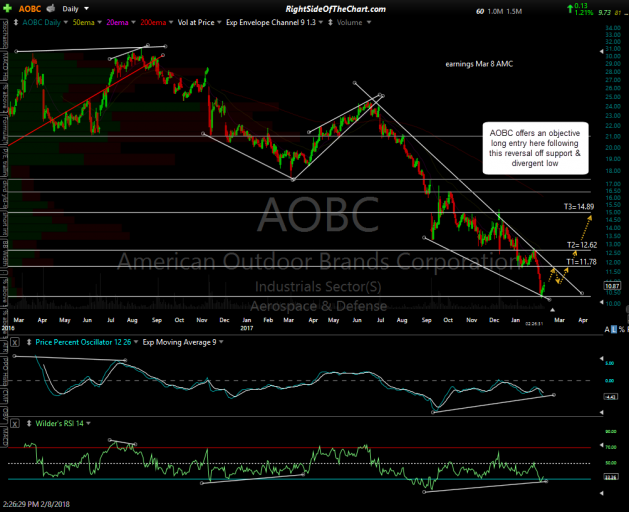

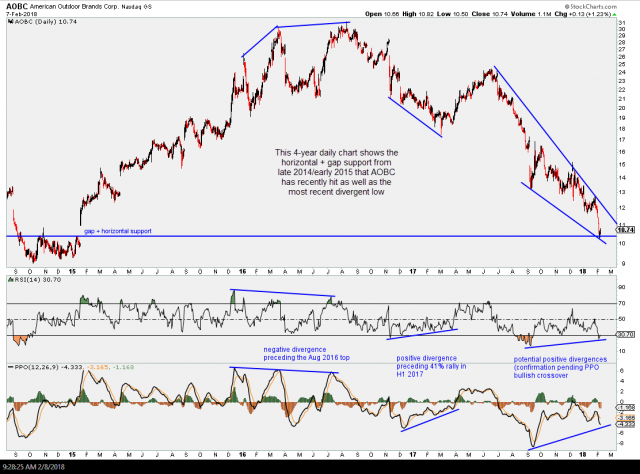

AOBC (American Outdoor Brands Corp, F.K.A. Smith & Wesson/SWHC) offers an objective long entry here following the recent reversal off support with bullish divergences forming on the momentum indicators. The price targets are T1 at 11.78, T2 at 12.62 & T3 at 14.89 with a suggested stop on any move below 9.80 (higher, if only targeting T1 or T2). The suggested beta-adjusted position size is 1.0.

- AOBC daily Feb 8th

- AOBC 4-yr daily Feb 8th

Please note that AOBC is scheduled to report earnings on Thursday, March 8th after the market close. As such, one should consider that taking a position in AOBC now will most likely entail holding the stock through earnings, especially if targeting T2 or T3. Those not comfortable with holding a position into earnings should either pass on this trade, book profits at T1 or close the position before the end of trading on March 8th.