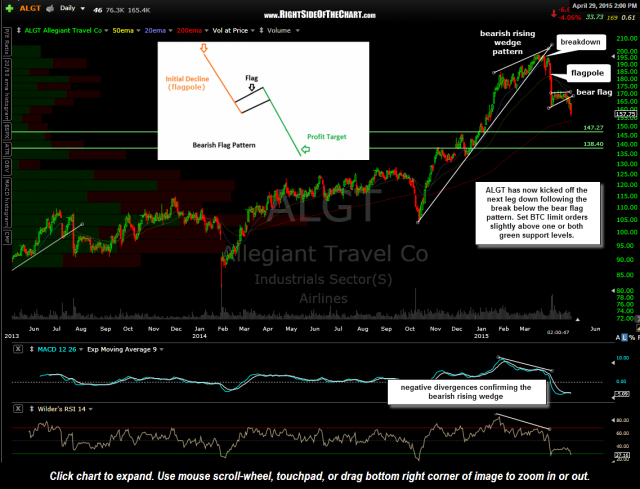

ALGT (Allegiant Travel) was one of the seven short trade ideas in the airline sector that were posted yesterday. The chart on ALGT looks like something straight out of a textbook on technical analysis:

First, ALGT recently hit the most extreme overbought conditions that the stock has ever experienced on the weekly time frame. Like most airline stocks, the recent bear market in oil prices was a huge boon to their bottom-line. It is far from coincidental that I have been bullish on crude for months while patiently waiting for the right time to short the airlines as their stock prices have ascended to a dangerous altitude, even as a solid bottom appeared to be forming in crude prices over the past several months.

Zooming down to this daily chart, ALGT formed a very steep, well-defined bearish rising wedge pattern, complete with negative divergences in place which re-affirm the bearish nature of the rising wedge pattern. Next, ALGT experienced an impulsive breakdown below the wedge pattern, made one last failed attempt at a new high & then plunged sharply, forming the “flagpole” leading up to the bear flag continuation pattern that was mentioned yesterday. From there, prices are now moving impulsively lower and are likely to hit one or both of the support levels on this chart (those are the actual support level, best to set any buy-to-cover limit orders slightly above those levels to help assure a fill, should the stock reverse just shy of support).

Note: For those subscribed to receive email notifications of new post, updated charts & notes on all 7 of the airline short trade ideas that were posted yesterday have been published. Email notifications were suppressed on most of those updates but are now available to view on RSOTC.com.