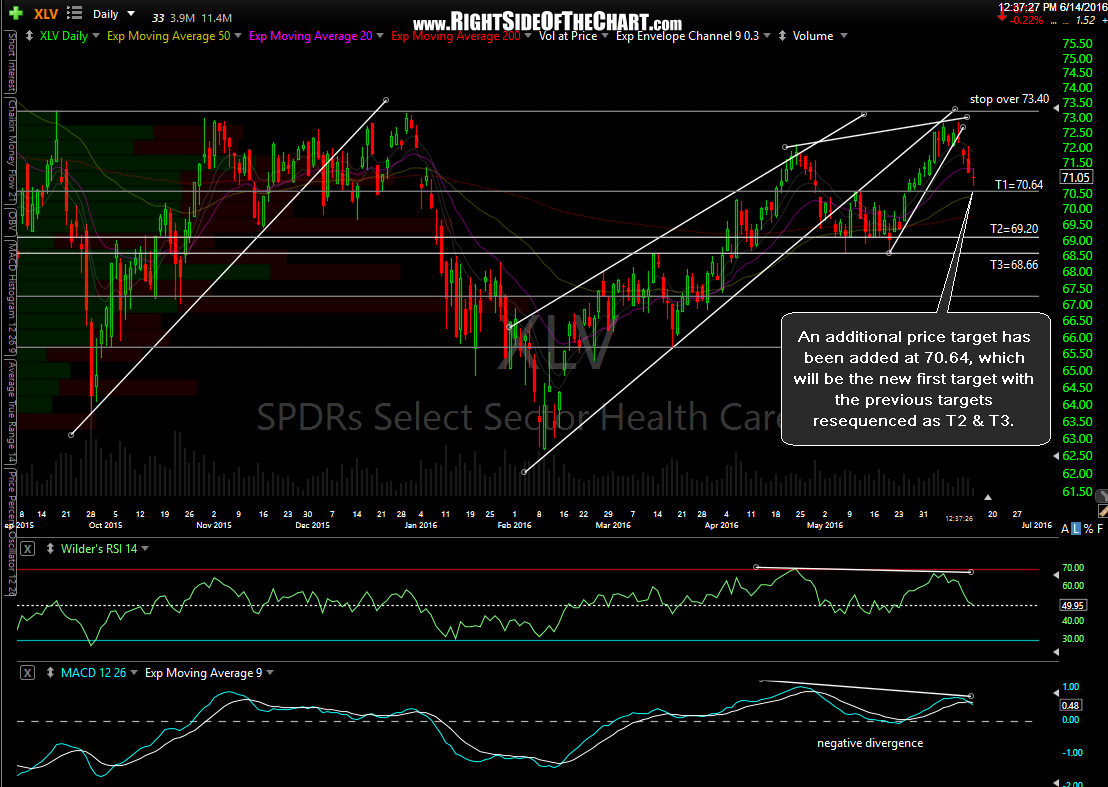

Upon further review of the charts, I have decided to add one additional price target to the XLV (Health Care ETF) at 70.64, which will be the new first target with the previous targets resequenced as T2 & T3. The suggested stop remains any move above 73.40 for now although it might be prudent at this point to lower stops to entry (72.40 was the official entry) in order to protect profits or assure a breakeven on the trade.

The fact that I have decided to add a price target above the previous first target (which is only slightly below today’s low) has nothing to do with my confidence in the trade. In fact, the potential negative divergence highlighted when this trade entry/setup was posted has now been confirmed, further confirming the bearish case & likelihood of a multi-week to multi-month drop in the health care sector. The reason for adding the new target at 70.64 is the same reason that I typically list multiple targets on the trade ideas; because I believe that the odds for a reaction off the inital tag of that level if/when XLV gets there will be elevated.

As usual, the price target is set slightly above the actual support level, which in this case is 70.59. There are several reasons for listing multiple prices targets which are discussed under the “Trading Related Questions” tab on the FAQ page.