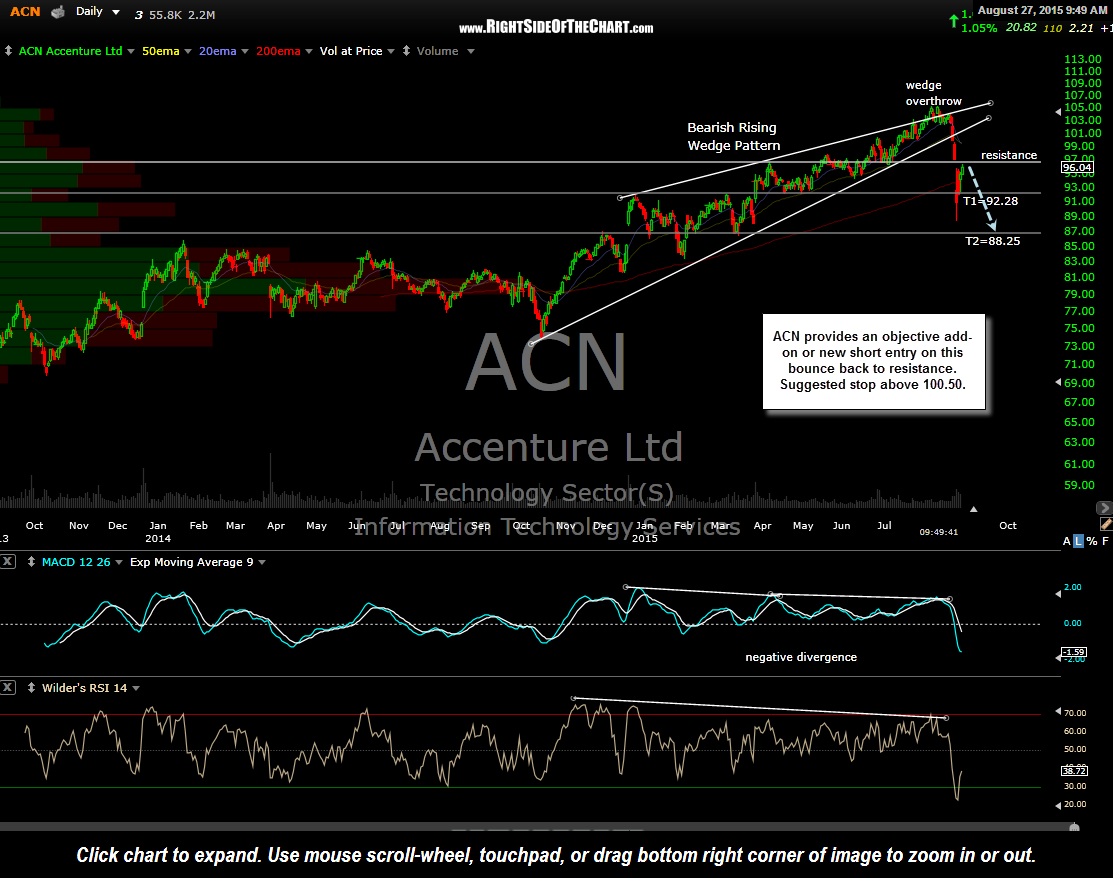

ACN provides an objective add-on or new short entry on this bounce back to resistance. Suggested stop above 100.50.

ACN was originally added as a short on Aug 2oth at 101.61 while still inside the wedge pattern (as the charts indicated an imminent breakdown was a high probability). ACN gapped past to the first price target of 92.28 to open at 91.06 for a quick 10.4% gain on the trade (for those targeting T1). Following this strong bounce back to a solid resistance level, the stock once again offers an objective new short entry or add-on to an existing short position for those targeting T2 (final target at 88.25), roughly 9% below current levels. The suggested stop for both this add-on/new short entry as well as the original short entry will both be on any move above 100.5o.

On a somewhat related note, I wanted to add that in addition to personally re-shorting ACN, which I had covered on Monday morning, I have also decided to add to my QQQ short position (still an unofficial trade). I have previously stated that I would only add to the position on strength (i.e.- with the market below where I recently flipped from long to short near the highs on Tuesday). Upon further review of the charts, I have nearly all major US equity indices as well as numerous market leading stocks once again at or slightly below solid resistance levels. At the very least, I would expect prices to stall out or experience a minor pullback from at or slightly above current levels with the odds for another big thrust down in the market still somewhat favorable at this time. Updates & charts on the broad market to follow asap.