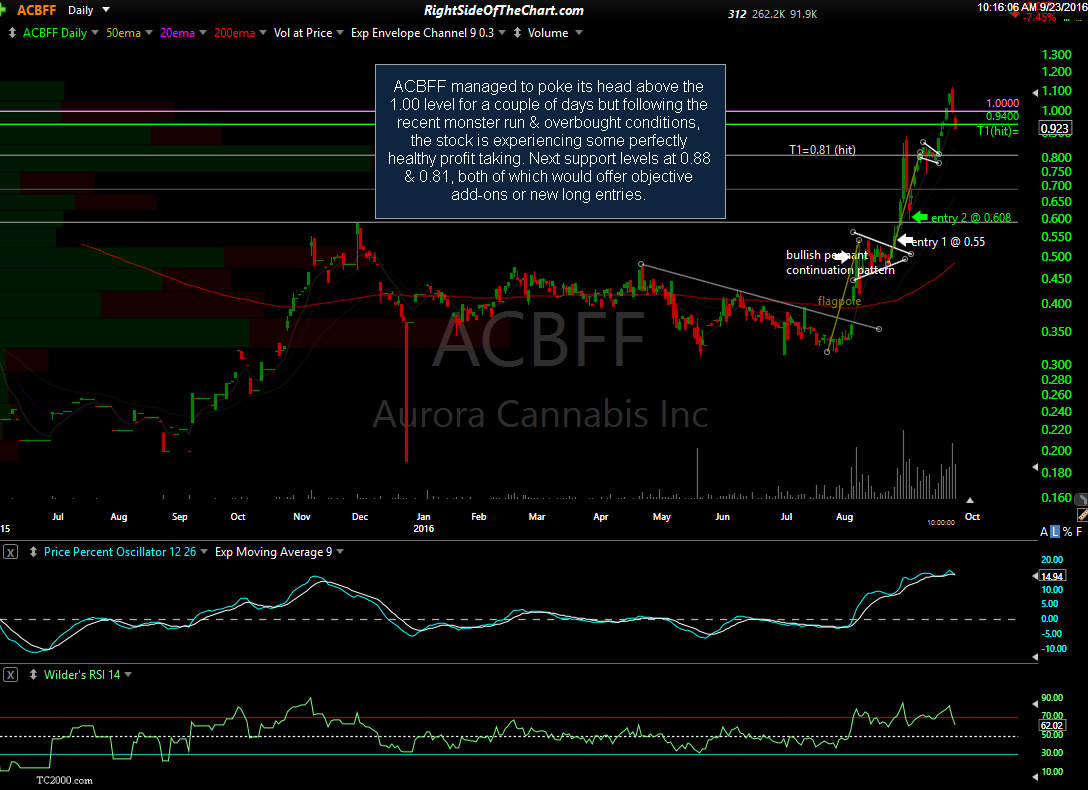

The ACBFF (Aurora Cannabis Inc) Active Long-term Trade managed to poke its head above the 1.00 level for a couple of days but following the recent monster run & overbought conditions, the stock is experiencing some perfectly healthy profit taking. Next support levels at 0.88 & 0.81, both of which would offer objective add-ons or new long entries.

The maximum suggested stop will be raised to the entry price of 0.551 from the original entry on ACBFF from this post on August 24th. However, one should consider a higher stop if their cost basis is higher. For example, ACBFF was also highlighted as another objective add-on to the Active Long-term Trade at 0.0608 on Aug 31st after the pullback that occurred immediately after the first swing trade target was hit on August 29th. As such, one should use their own unique cost basis as well as their own preferred stop allowance in determining their stops, especially if adding on this or any pullbacks going forward but for tracking purposes, the official stop on this trade will now be any move below 0.0551, with that stop likely to be raised soon if ACBFF can close above the 1.00 for more than one week.

A couple other recently highlighted but unofficial cannabis trade ideas worth mentioning today are CANN, which continues to run, already gaining about 45% since highlighted in the Cannabis Trade Ideas video just three days ago. From there, CANN went on to hit & take out the 1.20 resistance/target level (CANN was also mentioned as a stand-out with that 1.20 target on several occasions before this week’s video), with the stock moving sharping higher on high volume since Tuesday’s video.

GRNH was another marijuana stock highlighted in Tuesday’s video with a key downtrend line & horizontal resistance level to watch for a breakout at 0.05. GRNH broke out above both levels on Wednesday & has moved higher since, although volume is a bit lower than I would prefer to see. Regardless, the momentum seems to be behind many of the cannabis stocks for now. More updates on the sector soon.