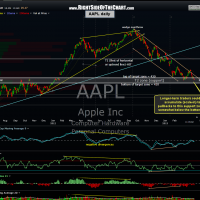

Here are the updated charts on the AAPL long trade. After hitting the first target for a modest gain, AAPL has fallen back to just below the entry levels (dual entries were posted on this trade). Although not my favorite of the current active trades, I understand that AAPL has a large following so I will make an effort to update this trade on a relatively frequent basis.

AAPL still has potential for a longer-term trade (possibly lasting several months or more) but the stock could continue to be “dead money” for a while as it continues to consolidate around the support zone that I’ve shown for many months now. Longer-term traders or investors interested in the stock could continue to accumulate (scale-in) on pullbacks into and towards the bottom of the support zone with a logical stop being on a break not too far below the bottom of the zone, possibly even on a weekly closing basis to avoid any brief stop-raids. 4 hour & daily charts:

On an administrative note, I have been very preoccupied with the recent changes being made to the back-end of the site such as the new email post notification system, adding registration access in order to customize your email alert settings as well as the new language translator feature. As is often the case in tech-land, one change to a website often triggers an issue or glitch with another part of the site. For example, shortly after rolling out the new translator feature, I noticed that the chart images would no longer open upon clicking. I’ve installed a back-up translator program that seems to work fine for now although the top of the site will appear slightly different than previous screenshot. Please pardon our dust as we roll out these new features to the site and work out any of the bugs that so often accompany such changes. If you notice any issues with the site, please let me know using the contact link which can be found under the Resources tab in the top menu of the site. Until these features are running smoothly, the posts and trade updates will be on the light side.

Thank you- Randy Phinney