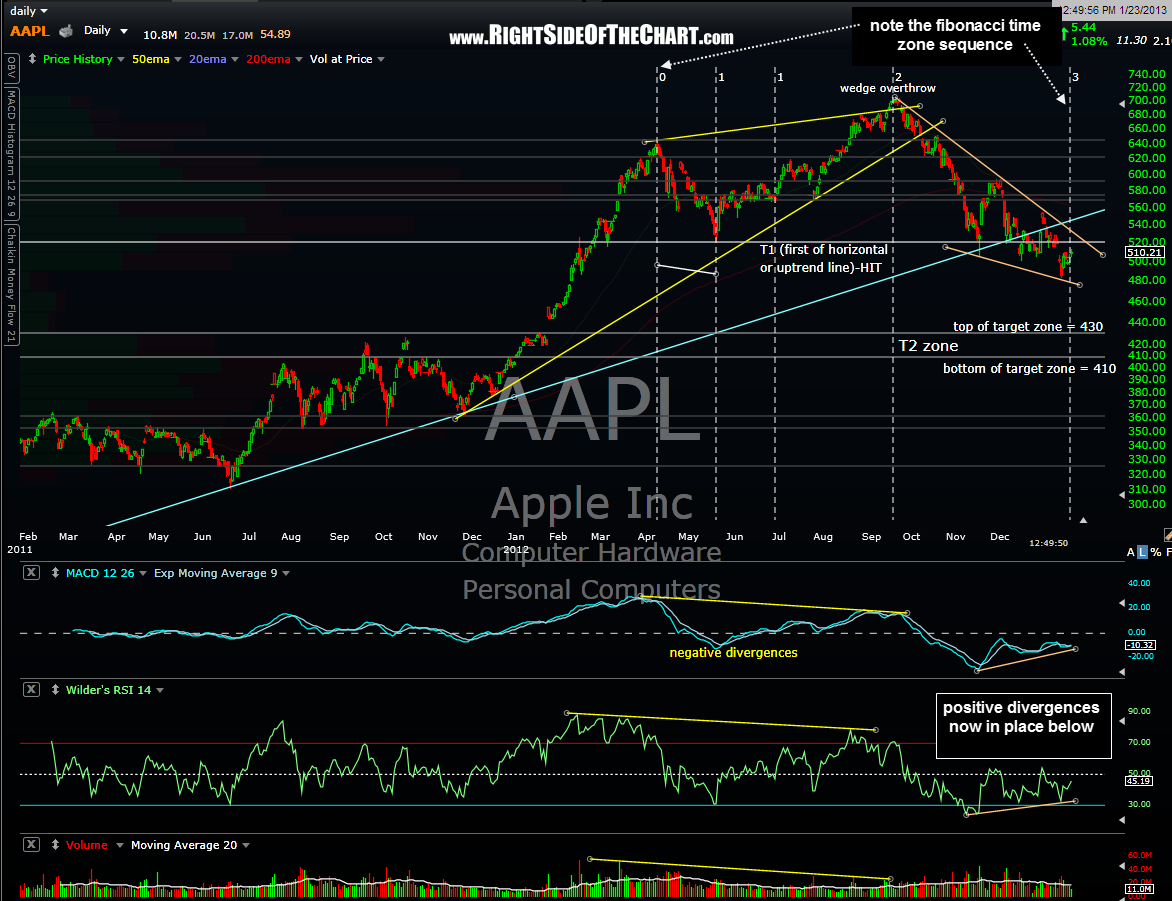

With many traders and investors eagerly awaiting AAPL’s earning release after the bell today, I figured that I’d post a chart in advance. While nothing has changed in months regarding my longer-term view, I have not added the stock back as a trade idea (or traded it personally) since that very nice short trade from near the highs to the just off the Nov mid-lows followed by that quick long-side trade off the lows that milked a good percentage of the ensuing bounce yet side-stepping the most recent correction and drop to new lows. I still don’t have enough confidence in the charts to add AAPL back as a trade yet, long or short, but did want to point out this potential bullish falling wedge pattern on the daily chart (orange trendlines). Keep in mind that even if AAPL were to breakout above that pattern tomorrow following the earnings release tonight that the stock still has considerable overhead resistance to contend with, including that longer-term uptrend line (blue). This falling wedge pattern does have positive divergences below on both the MACD & RSI and one other interesting observation that I made was the fibonacci time zones that I added to the chart last night. I started the time zone sequence at the April 10th, 2012 peak high in AAPL, setting the next line at the 5/18/12 trough low. The remaining lines auto-populate based on the fibonacci sequence but as you can see, each additional line marked a significant inflection point in the stock; the June 28, 2012 low that followed a period of consolidation and marked the launching point of a rally that took the stock from 522.18 to it’s all-time high, which coincidentally or not, was where the next fib time zone fell. Like anything in technical analysis, these don’t work all the time but it will be interesting to see if the stock makes a trend reversal (or begins a sharp move lower) from around this current fib level. Either way, something to watch, especially that potential bullish falling wedge pattern. If AAPL does break above the pattern or prices continue to hold up within it, I may add some upside price targets for the stock.

I still don’t have enough confidence in the charts to add AAPL back as a trade yet, long or short, but did want to point out this potential bullish falling wedge pattern on the daily chart (orange trendlines). Keep in mind that even if AAPL were to breakout above that pattern tomorrow following the earnings release tonight that the stock still has considerable overhead resistance to contend with, including that longer-term uptrend line (blue). This falling wedge pattern does have positive divergences below on both the MACD & RSI and one other interesting observation that I made was the fibonacci time zones that I added to the chart last night. I started the time zone sequence at the April 10th, 2012 peak high in AAPL, setting the next line at the 5/18/12 trough low. The remaining lines auto-populate based on the fibonacci sequence but as you can see, each additional line marked a significant inflection point in the stock; the June 28, 2012 low that followed a period of consolidation and marked the launching point of a rally that took the stock from 522.18 to it’s all-time high, which coincidentally or not, was where the next fib time zone fell. Like anything in technical analysis, these don’t work all the time but it will be interesting to see if the stock makes a trend reversal (or begins a sharp move lower) from around this current fib level. Either way, something to watch, especially that potential bullish falling wedge pattern. If AAPL does break above the pattern or prices continue to hold up within it, I may add some upside price targets for the stock.