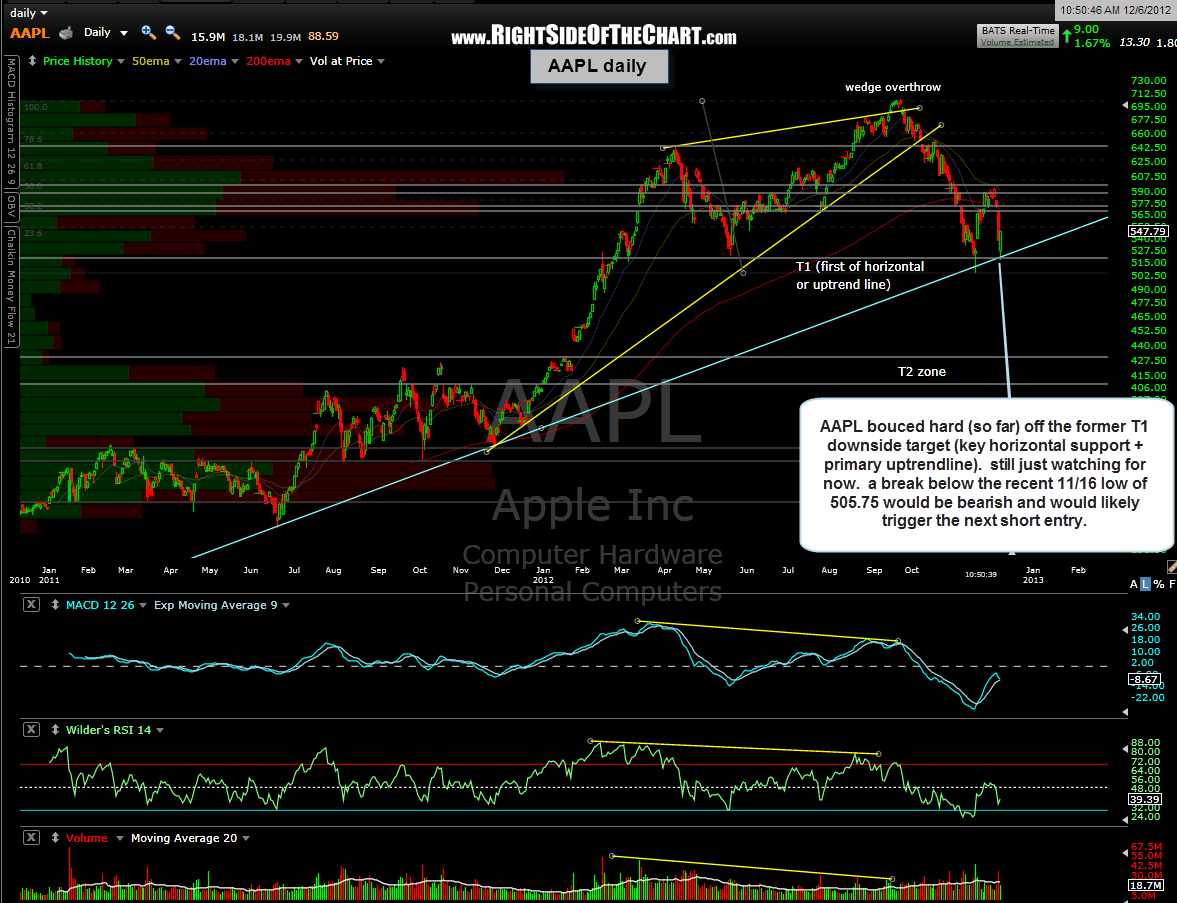

While I haven’t yet added AAPL back as either a short or a long trade, here are the updated daily & 4-hour period charts with some notes. I still prefer to watch the stock from the sidelines for now but more active traders might want to take advantage of these charts for quick trading opportunities. As you can see, AAPL gapped down today and moved lower to once again hit that key support level on these charts, especially that key horizontal support and primary uptrend line on the daily chart (which is also T2 on the 4-hour chart). So far, the buying that kicked in off that level has been impulsive (strong price advance on strong volume) so I’d like to see how the stock follows up from here going forward before establishing another swing-trade position in AAPL.

I have also added a couple of resistance levels (dotted lines) on the 4 hour chart (above) that might come into play. Overall, I remain longer-term bearish on the stock for now & my expectation is that the selling will likely resume shortly. One thing to watch for would be a break below the Nov. 16th lows of 505.75. If that were to happen relatively soon, it would greatly increase the odds that AAPL is now in a 3rd wave down of a 5-wave primary downtrend trend. For those of you familiar with Elliot Wave Theory, the third waves are typically the most powerful and this scenario would align well with AAPL hitting my next downside target that I’ve shown for months now. That target is T1 on my weekly chart (432 area) and also shown as the T2 zone on the daily chart (410-432). If AAPL were to move down in an very impulsive manner to that level, it would likely be followed by a wave 4 up counter-trend bounce, then a final wave 5 down move to the next support level that I’ve also shown for a while as well (support zone at 353-362 on the daily frame and the weekly T2 at 360), as illustrated on this daily chart below: