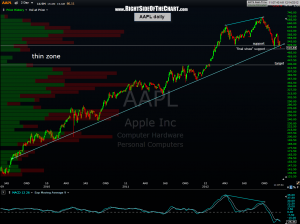

I’m going to run out for a bit but wanted to once again impress upon the importance of AAPL as it remains in a very precarious technical position. I believe that the odds are elevated for a very substantial sell-off in the markets at this time if AAPL continues to fall much lower. This 2-day period chart shows how AAPL has now broken below a very well defined trendline that has defined the

I’m going to run out for a bit but wanted to once again impress upon the importance of AAPL as it remains in a very precarious technical position. I believe that the odds are elevated for a very substantial sell-off in the markets at this time if AAPL continues to fall much lower. This 2-day period chart shows how AAPL has now broken below a very well defined trendline that has defined the current former uptrend for over 3 years. As mentioned earlier, the stock has also entered into a very pronounced thin zone and I have covered the longer-term bearish technicals (daily thru weekly divergences, weekly trendline breakdown, etc..) for months now.

Please realize that although a bounce from at or near current level is possible, I do still believe that AAPL will ultimately reach my next downside target (430-410) area and I think the odds favor that happening sooner than later, most likely by the end of January and quite possible sooner. Also keep in mind that the elevated chance for a powerful broad market sell-off at this time (most likely to begin next week if it were to happen) is a warning, not a prediction (click here to review the difference between the two). I would urge caution for those positioned heavily long and consider tightening stops, booking some profits or preparing hedge positions if the markets and AAPL close substantially lower today.

As always, support is support until broken and AAPL may just want a simple re-test of the recent lows before moving higher so for those with a more bullish outlook on the market, one could always take a shot at an AAPL long here around 510 with a relative tight stop below the 490-500 area (they will typically take a stock just below the recent lows to blow out the stops and suck in some more shorts before gunning it higher). Final support would be the Nov 16th lows at 505.75 & hence the reason for giving a little more room on the stops. Again, my primary scenario is that AAPL goes much lower before much higher and as such, I am not adding AAPL as a long trade. However, I did want to point out that option since I am aware that my primary scenario may not play out and I do my best to present trade opportunities on both long or short side, regardless of my own market bias at the time.