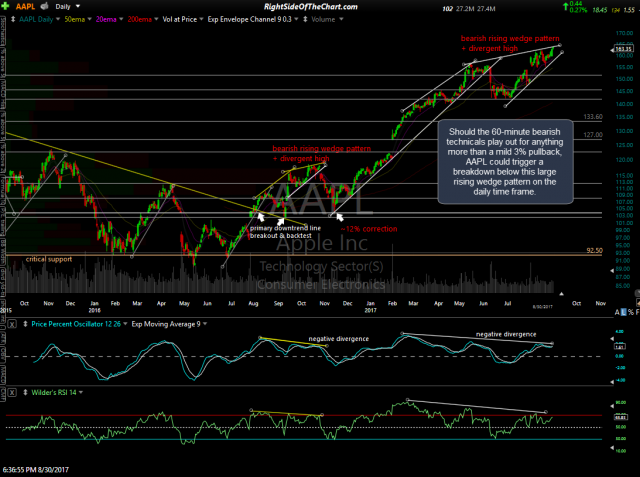

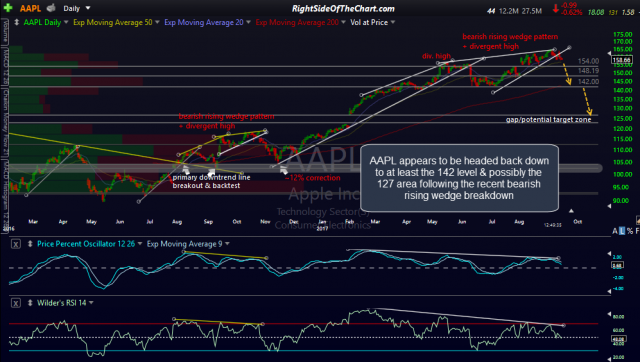

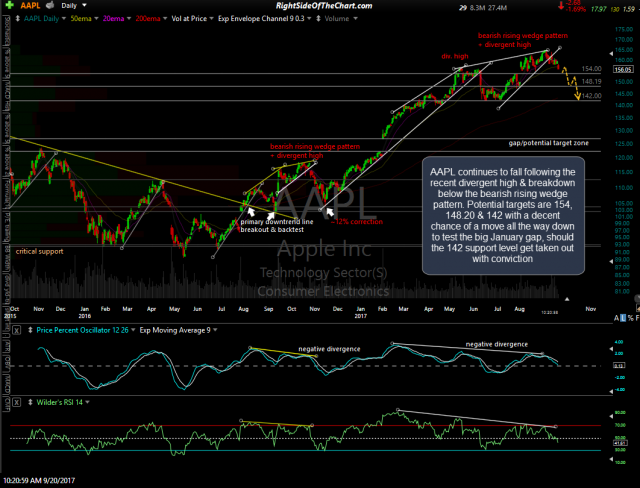

The largest component of both the Nasdaq 100 as well as the S&P 500, AAPL (Apple Inc.) continues to fall & still appears to be headed down to any of all of the support levels/targets listed on this daily chart following the breakdown below the bearish rising wedge pattern breakdown that has been highlighted over the past 3 weeks. The potential targets are 154, 148.20 & 142 with a decent chance of a move all the way down to test the big January gap, should the 142 support level get taken out with conviction. While not an official trade idea at this time, I’m monitoring the price action in AAPL closely as any additional weakness in the stock could spill over into the rest of the technology sector as well as the broad market. Previous & updated daily charts:

- AAPL daily Aug 30th

- AAPL daily Sept 14th

- AAPL daily Sept 20th

PHM (Pulte Homes Inc) is a homebuilding stock under consideration for an official trade setup with a short entry on a break below this bearish rising wedge pattern. Unofficial trade idea at this time but just wanted to pass it along for those interested.