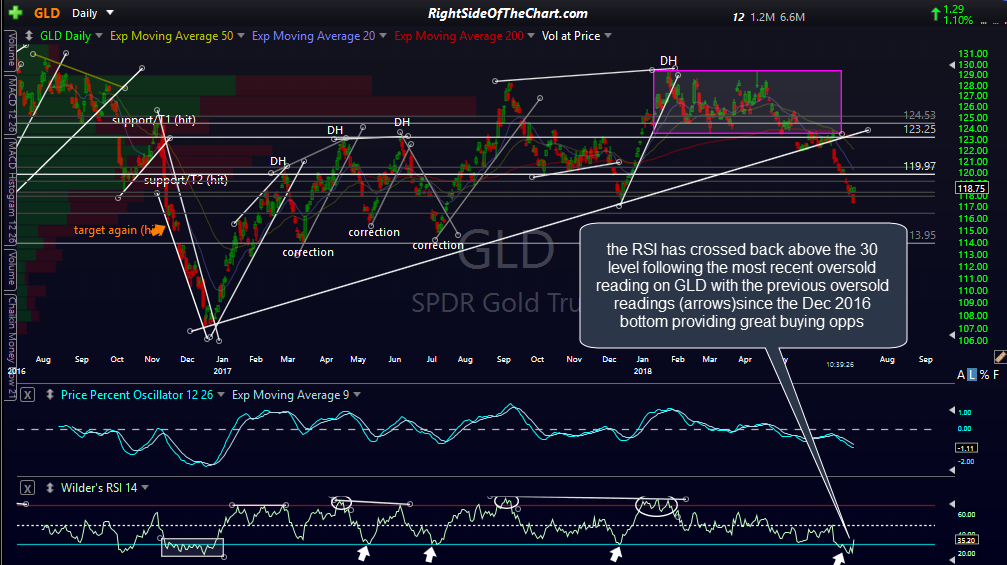

It appears that today’s nice rally in GLD could be the start of a new uptrend, at least a tradable rally. One sign of confirmation that I like to use is the daily RSI crossing back above the 30 level after becoming oversold (i.e.- falling below 30). If gold is still in a primary uptrend since the late 2016 lows, this could mark the beginning of the next major leg up.

However, if gold put in a bull market top in late Jan of this year, then one would expect that this recent oversold reading might soon be followed by another dip down to or below the 30 level on the daily RSI. FWIW, I still favor the former over the latter.

With today being an abbreviated trading session in the US markets followed by a full closure tomorrow, I’d prefer to hold off until the markets re-open on Thursday before considering GLD and possibly GDX as official trade ideas although I wanted to share my thoughts before then.

Just a reminder: I will be on a semi-working vacation through the end of next week with limited computer & email access. I will reply to chart requests and other questions at my earliest convenience. Thank you for your patience & for those in the US, have a safe & happy 4th!