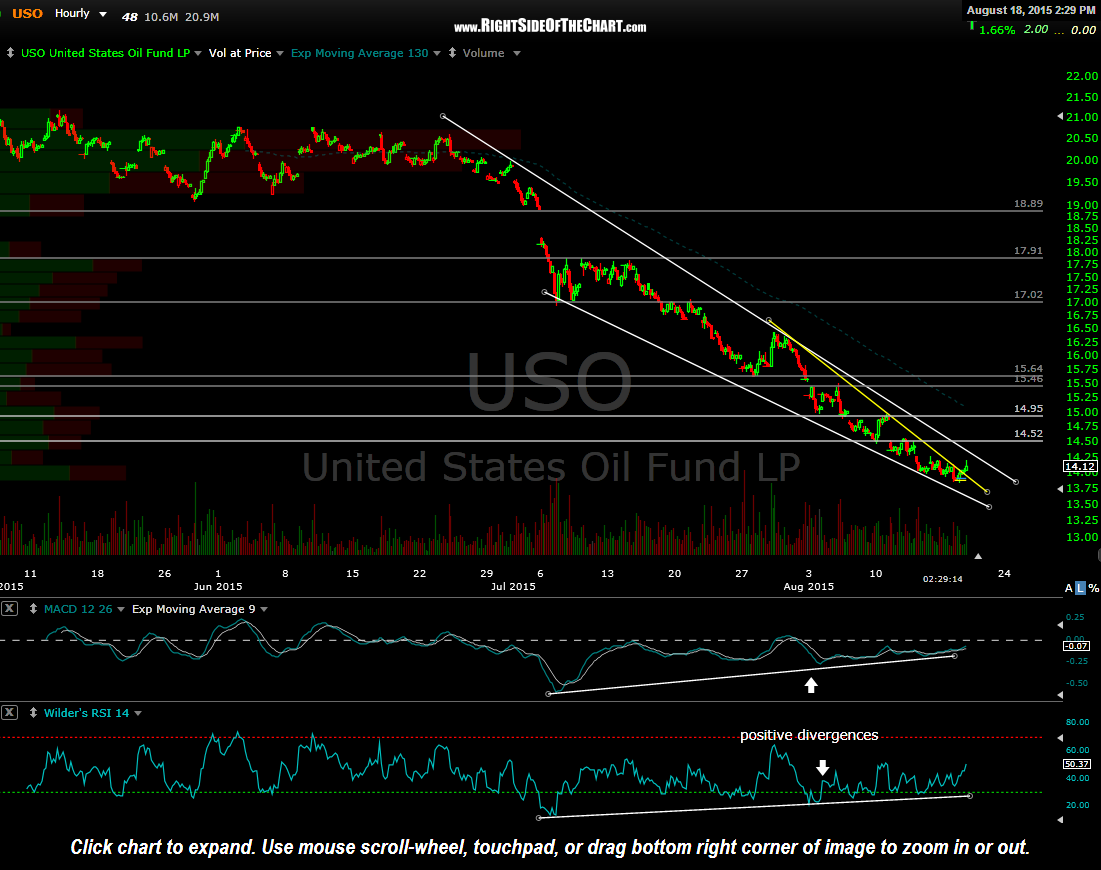

This is pretty much the same bullish falling wedge pattern posted on the recently stopped out USO long/DWTI short trade, only prices have continued lower within the pattern since. I’ve added a yellow minor downtrend line within the pattern which USO has broken above today. Another unofficial trade idea for those looking to play an oversold bounce (and quite possibly a longer-term entry for a potential bottoming play as $WTIC is at long-term support… more on that later).

Horizontal lines mark overhead resistance levels/targets. Consider setting sell limit orders a few cents below as these are the actually resistance levels, unadjusted for an optimal fill. One strategy might be to establish a starter position here on the break above the minor downtrend line, adding on a break or 60-minute close above the primary (white) downtrend line. The 15.50 area would be my preferred bounce target at this time.