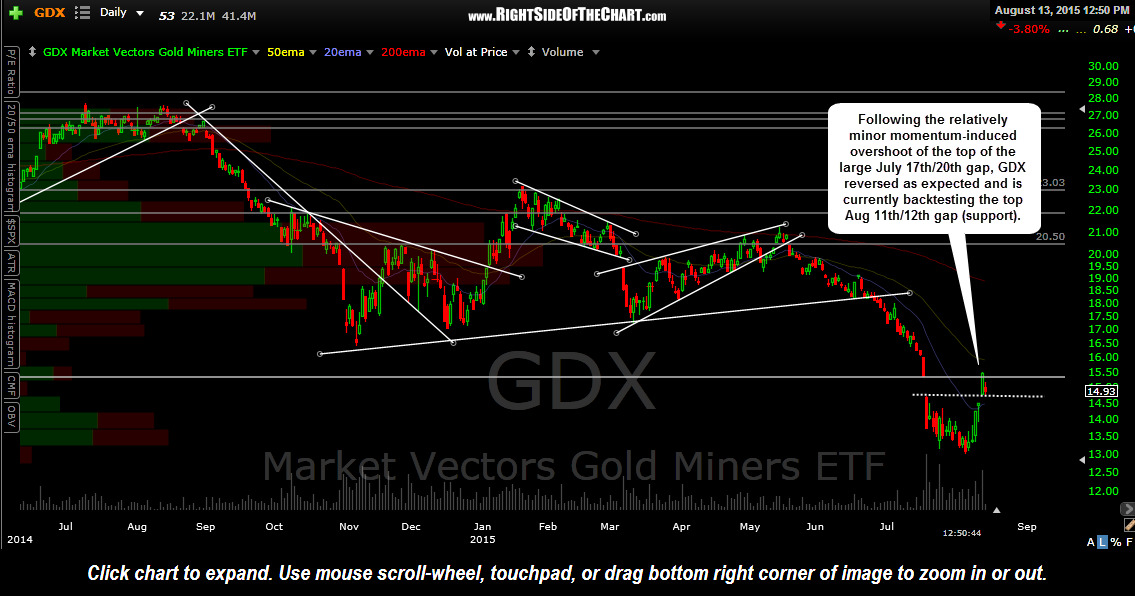

Following the relatively minor momentum-induced overshoot of the top of the large July 17th/20th gap, GDX reversed as expected and is currently backtesting the top Aug 11th/12th gap (support).

This 30-minute chart below highlights two support levels, both gap support, are likely to contain any pullbacks in GDX, should gold & silver prices start to firm up. Again, gold & silver are both still at or just below important technical levels (highlighted yesterday) so whether a pullback to either of these near-term support levels on the chart above prove to be good entry points for a long-side trade in the miners will most depend on how the metals trade going forward. With that being said, one could certainly take a long position in the GDX or select miners here or on a backfill of Wednesday’s gap with stops placed somewhat below the bottom of Tuesday’s high.