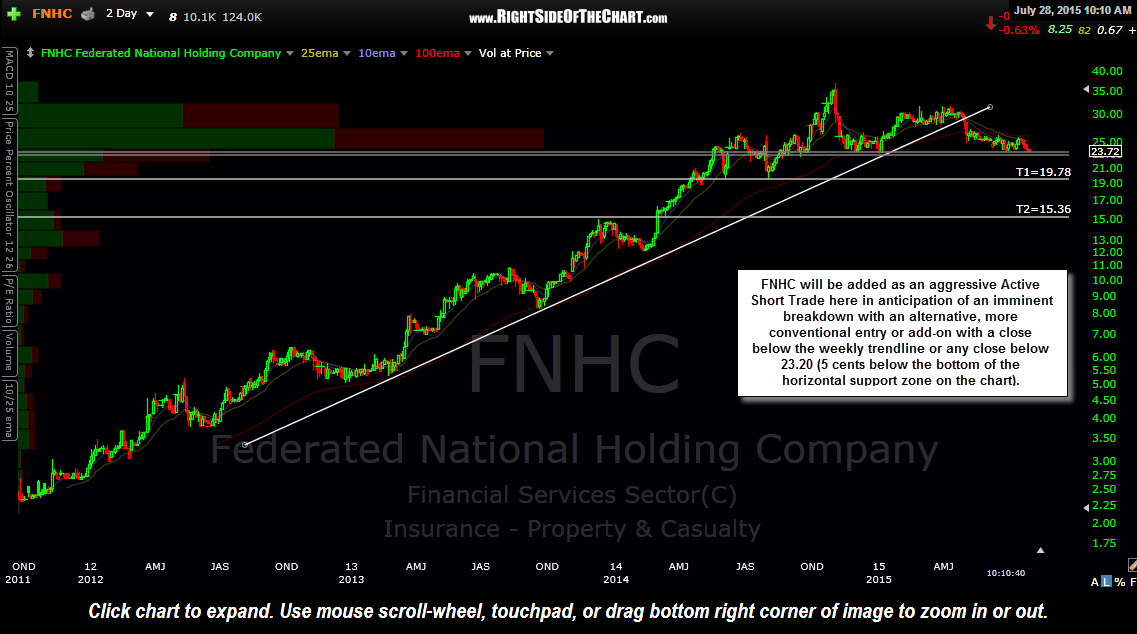

FNHC (Federated National Holding Co.) will be added as a somewhat aggressive Active Short Trade here in anticipation of an imminent breakdown with an alternative, more conventional entry or add-on with a close below the weekly trendline or any close below 23.20 (5 cents below the bottom of the horizontal support zone on this 4-year, 2-day period chart below). As of now, the official price targets are T1 at 19.78 & T2 at 15.36 with a suggested stop over 26.50.

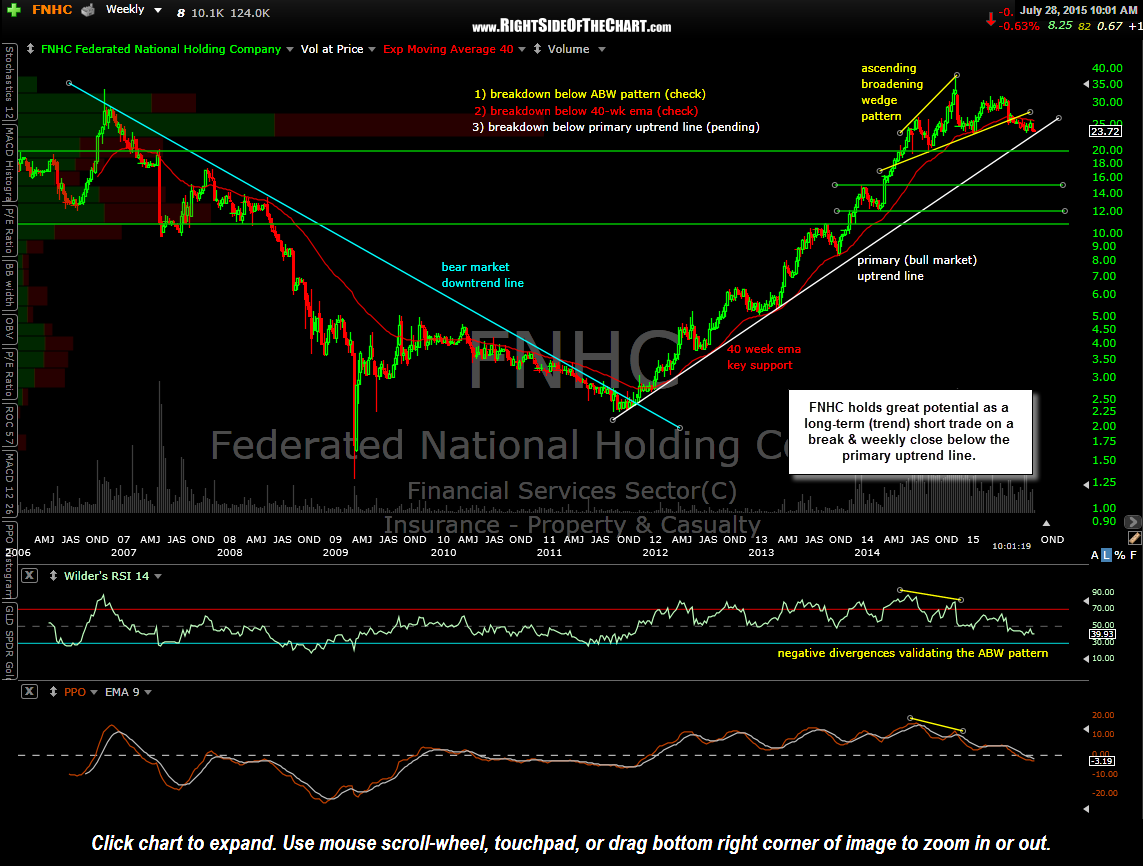

This 10-year weekly chart stands out as one of the most promising longer-term swing or trend trade shorts at this time. I am currently short the financial sector via FAS and within the financial sector, there are several insurance companies, such as FNHC, that look poised for substantial downside in the coming months. The green horizontal lines on this weekly chart represent additional downside targets for Federated National, should the insurance sector roll over soon as expected.