I’ve have several inquires about the EA (Electronic Arts) Active Short Trade & Short Setup recently & figured that I’d share my thoughts. I still think this trade looks promising and is very likely to play out if & when the broad markets start moving lower and quite possibly, regardless of what the broad market does.

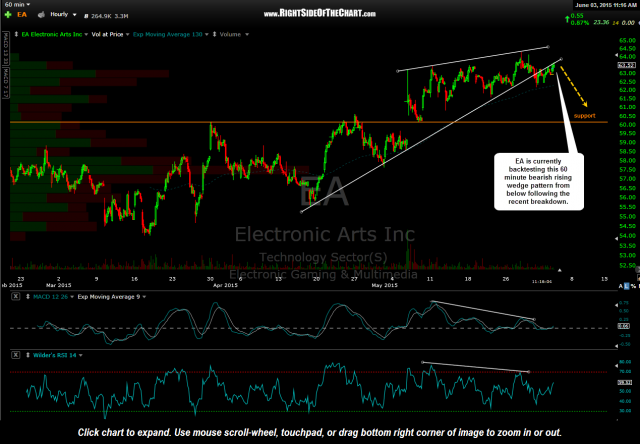

These case for shorting an initial position in EA was made in this original post on May 11th, with the next objective entry or add-on to come on a break below the daily bearish rising wedge pattern, which occurred on Friday afternoon. Since then, EA has moved higher in sympathy with the broad market, while backtesting the rising wedge pattern from below (a relatively common occurrence following a wedge breakout or breakdown).

- EA 60 minute June 3rd

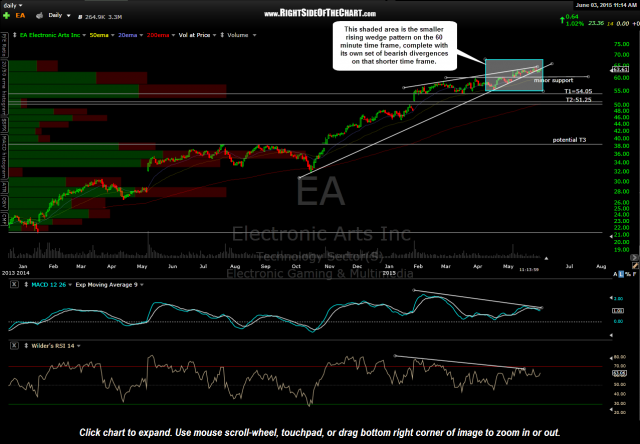

- EA daily June 3rd

The updated daily chart above shows the larger, more powerful rising wedge pattern generated off of the mid-October 2014 lows while the 60-minute chart above is essentially a zoomed in view of the upper-most portion of that wedge (off the mid-April 2015 reaction low).

Bottom line is that EA still looks to offer an attractive R/R as a multi-month swing trade candidate as the stock approaches major long-term resistance (see weekly chart in the original post) while wedging higher with bearish divergences in place on most time frames. While this trade, or any short trade for that matter, does not need the broad market to fall in order to play out, should the broad markets begin a new short-term and/or intermediate-term downtrend soon, that would greatly increase the odds of the EA short reaching T1 or T2 (the current final & preferred price target).