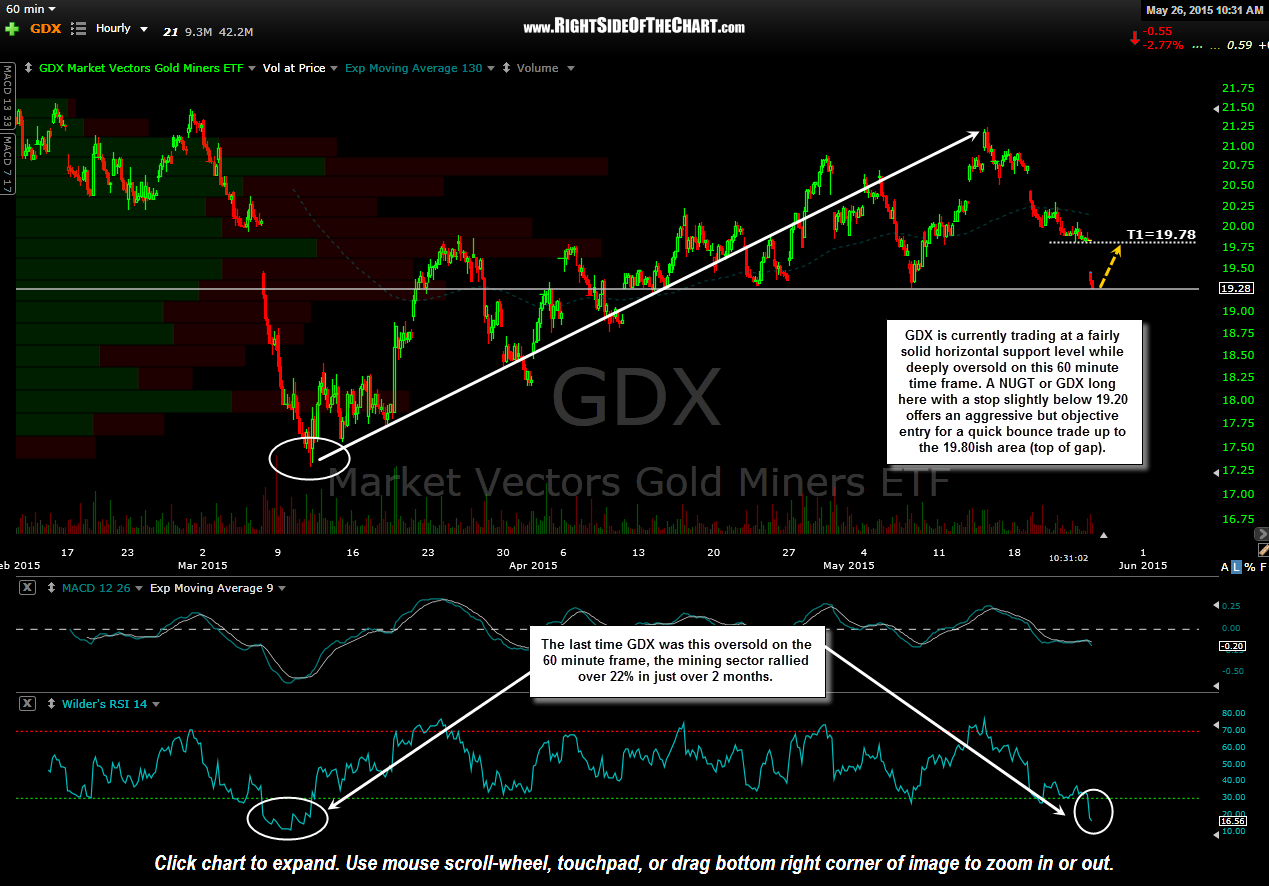

I came into the day short GDX (Gold Miners ETF) which I just reversed to a long position. GDX is currently trading at a fairly solid horizontal support level while deeply oversold on this 60 minute time frame. A NUGT or GDX long here with a stop slightly below 19.20 offers an aggressive but objective entry for a quick bounce trade up to the 19.80ish area (top of gap). The sole profit target for this trade is 19.78 which is set slightly below the actual resistance/top of the gap at 19.83, providing a very attractive R/R of over 5.5:1.

Normally I don’t add the very short-term trades, i.e.- trades expected to last just hours or days, as official (Active) Trade ideas but being that I just returned from vacation & have some catching up on the charts to do, it might be a day or so before I find any new typical swing trade or long-term trade candidates.

Also note that several of the airline active short trades have hit one or more profit targets since I left town last week. Those trades will be updated asap.