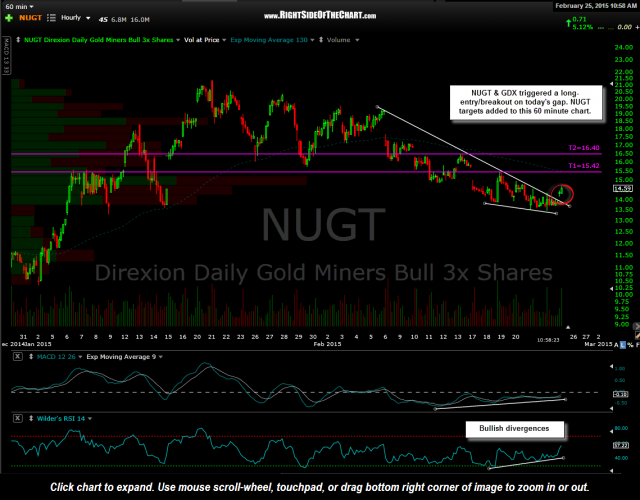

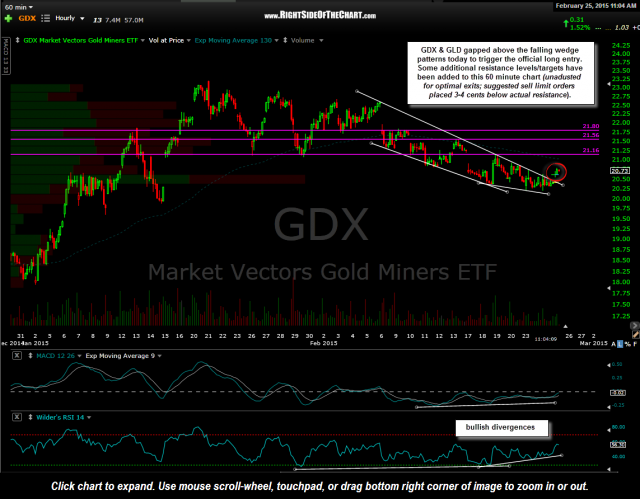

With both GDX & NUGT now clearly above their respective bullish falling wedge patterns following the gap higher/breakout triggered at the open, I have added some new price target to both the NUGT and GDX trade. As NUGT is a 3x leveraged ETF, more suitable to short-term trades measured only in hours or days, I only have 2 near-term price targets for NUGT with an additional upside target, 3 total at this time, for GDX , as GDX is not prone to the price decay that its leveraged counter-part is.

- NUGT 60 minute Jan 25th

- GDX 60 minute Feb 25th

The price targets shown on this NUGT 60 minute chart are the actual suggested sell limit levels, set slightly below the actual resistance levels in order to help assure a fill, should prices reverse just shy of resistance. The levels shown on the GDX chart (21.16, 21.56 & 21.80) are the actual resistance levels, unadjusted for optimal fills. Therefore, the actual price targets (sell limit orders) should be set about 3-4 cents below those levels.

note: NUGT (3x long gold miners etf) was mistakenly referred to as DUST (3x short gold miners etf) in a few instances in the previous two post from Friday & earlier today. Those typos have now been corrected.