Following the recent potential wash-out/bear-trap move below the 114.50ish triple-bottom support, GLD has been backtesting that support level from above, possibly building the energy to mount a sustained breakout above the yellow downtrend line (bullish scenario), while a solid move back below 114.50 & especially the 109 area would be bearish. While the longer-term trend is still down to sideways, the current short-term trend is up with GLD making a series of higher highs & higher lows over the last 5 1/2 weeks.

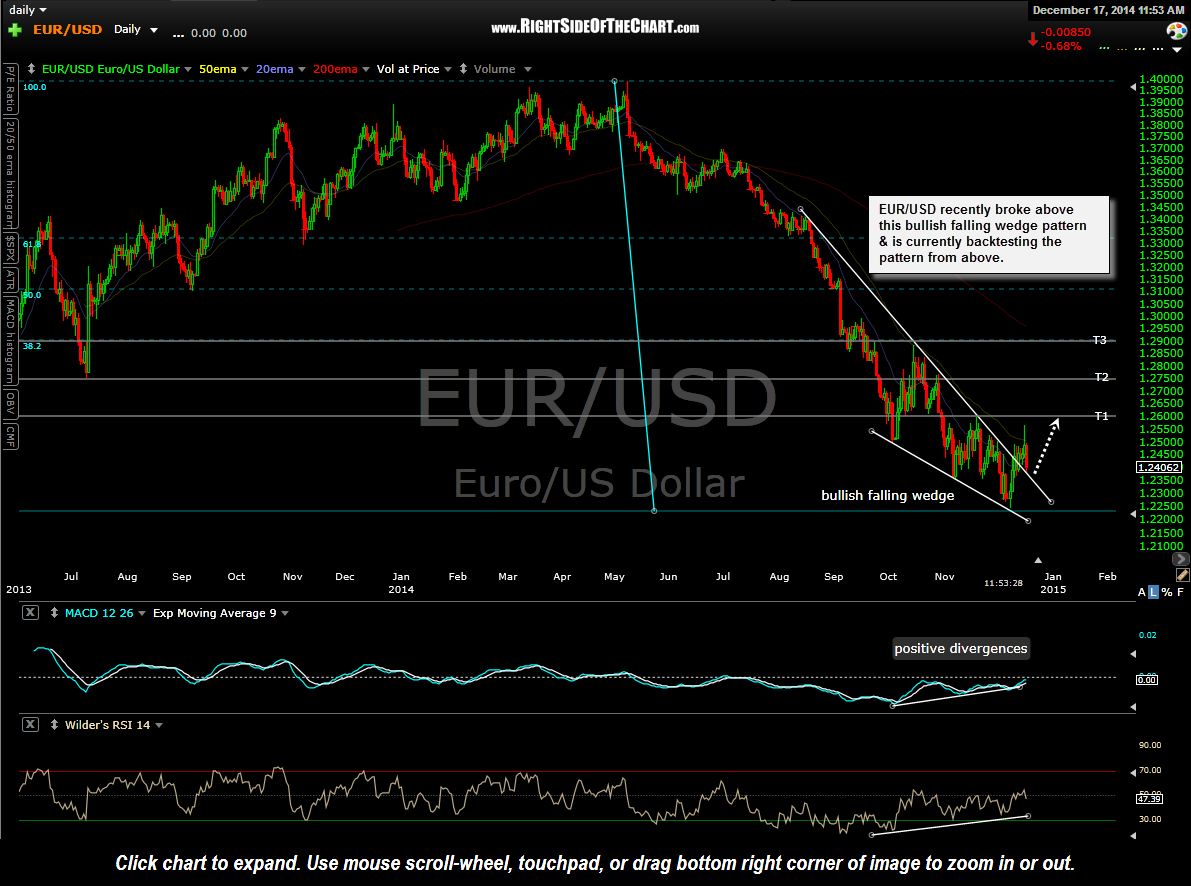

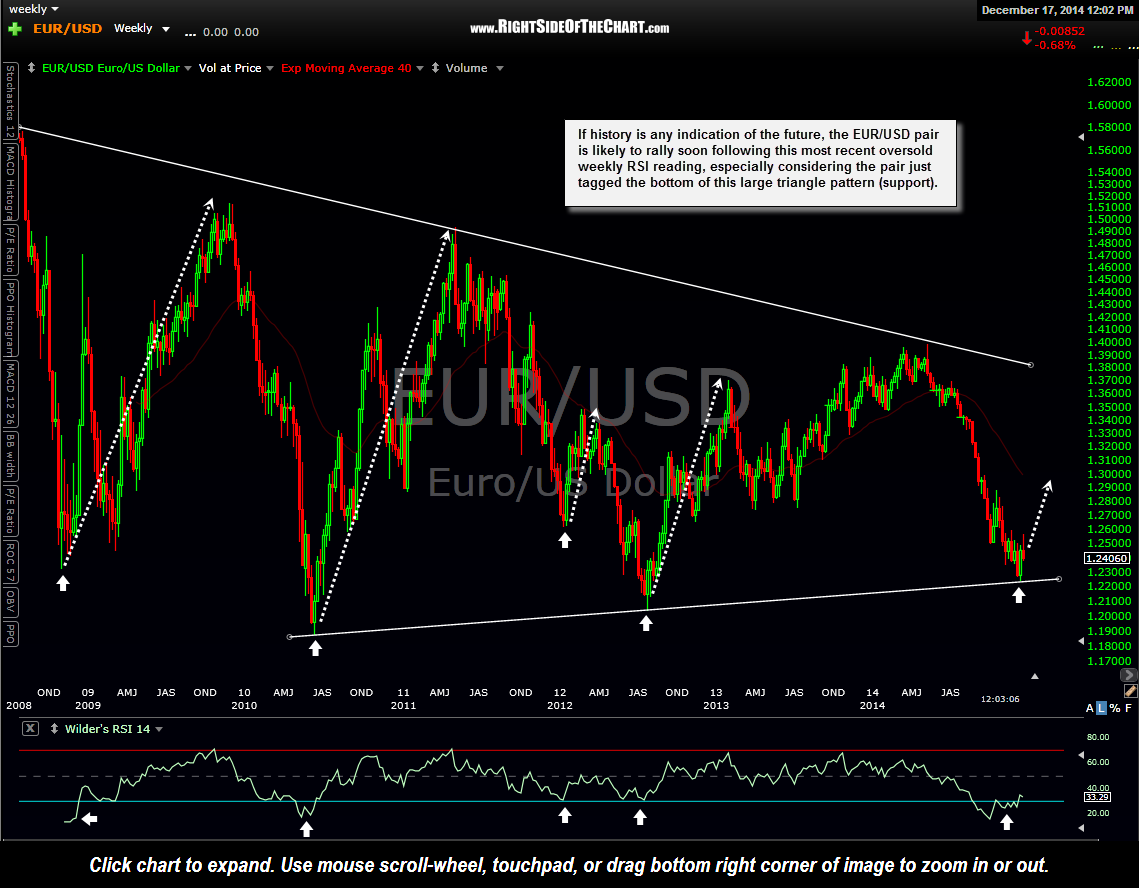

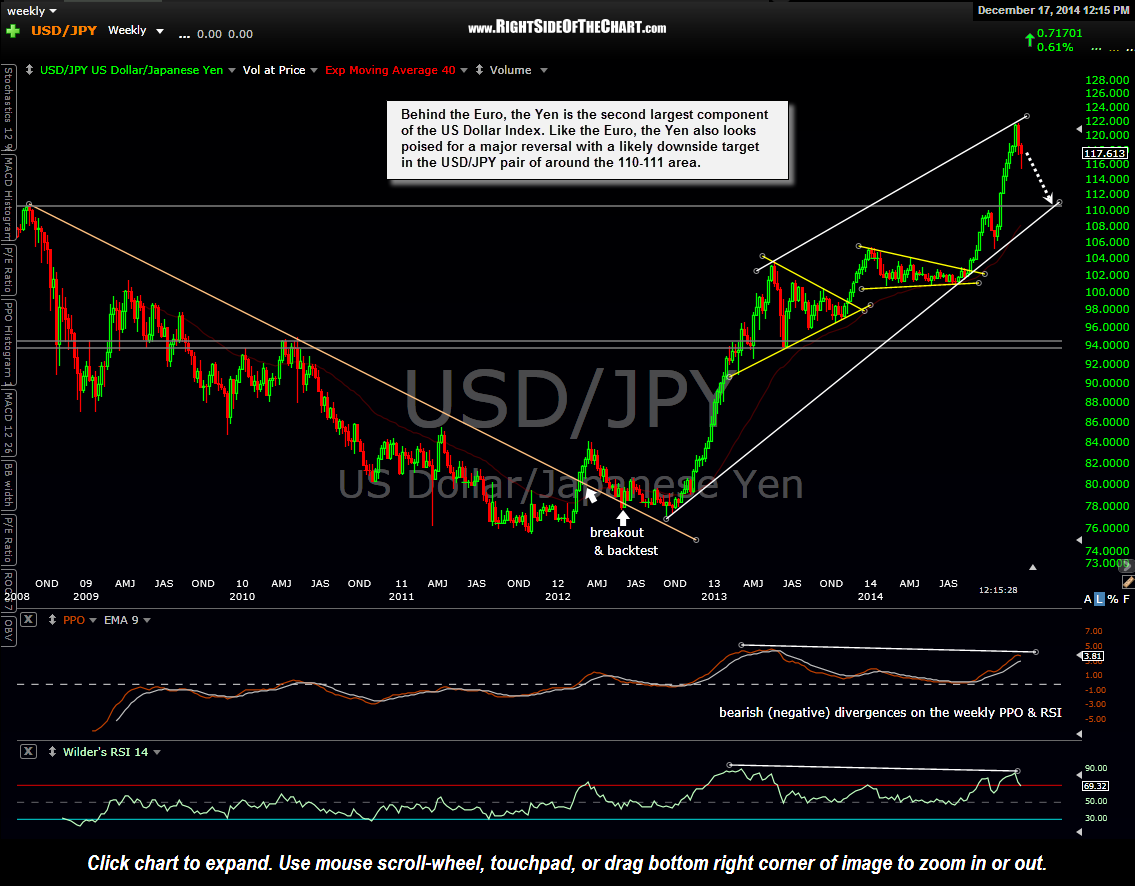

EUR/USD recently broke above this bullish falling wedge pattern & is currently backtesting the pattern from above. The Euro alone accounts for nearly 58% of the performance of the US Dollar Index ($DXYO/$USD). If history is any indication of the future, the EUR/USD pair is likely to rally soon following this most recent oversold weekly RSI reading, especially considering the pair just tagged the bottom of this large triangle pattern (support).