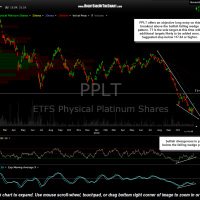

PPLT (Physical Platinum Shares ETF) offers an objective long entry on this breakout above the bullish falling wedge pattern. T1 is the sole target at this time with additional targets likely to be added soon, depending on how the charts play out going forward. Suggested stop below 117.64 or higher if targeting only T1 although longer-term traders & investors might consider a scale-in strategy with higher price targets & wider stops.

With the $USD still in an uptrend and GLD currently still attempting to solidly take out the 115 level, more conservative traders & investors might opt to wait for those aforementioned events (dollar reversal & a confirmed GLD breakout) to occur before establishing a position. We’ve also yet to see a confirmed, end-of-day breakout in $PLAT (spot platinum prices) although keep in mind that the spot charts below are EOD (end-of-day) and reflect yesterday’s closing prices. Platinum futures are currently trading up nearly 2% so a close above the downtrend line on the daily spot chart below today is likely, barring a reversal into the close.

Daily chart of PPLT along with the daily & weekly charts of $PLAT (end-of-day spot platinum prices) below. Besides PPLT & futures, there are several other options for trading platinum although these are all thinly-traded ETFs: PGM, PTM, PLTM, LPLT, & SPPP. Click here for information on PPLT.

- PPLT daily Nov 21st

- $PLAT daily Nov 21st

- $PLAT weekly Nov 21st