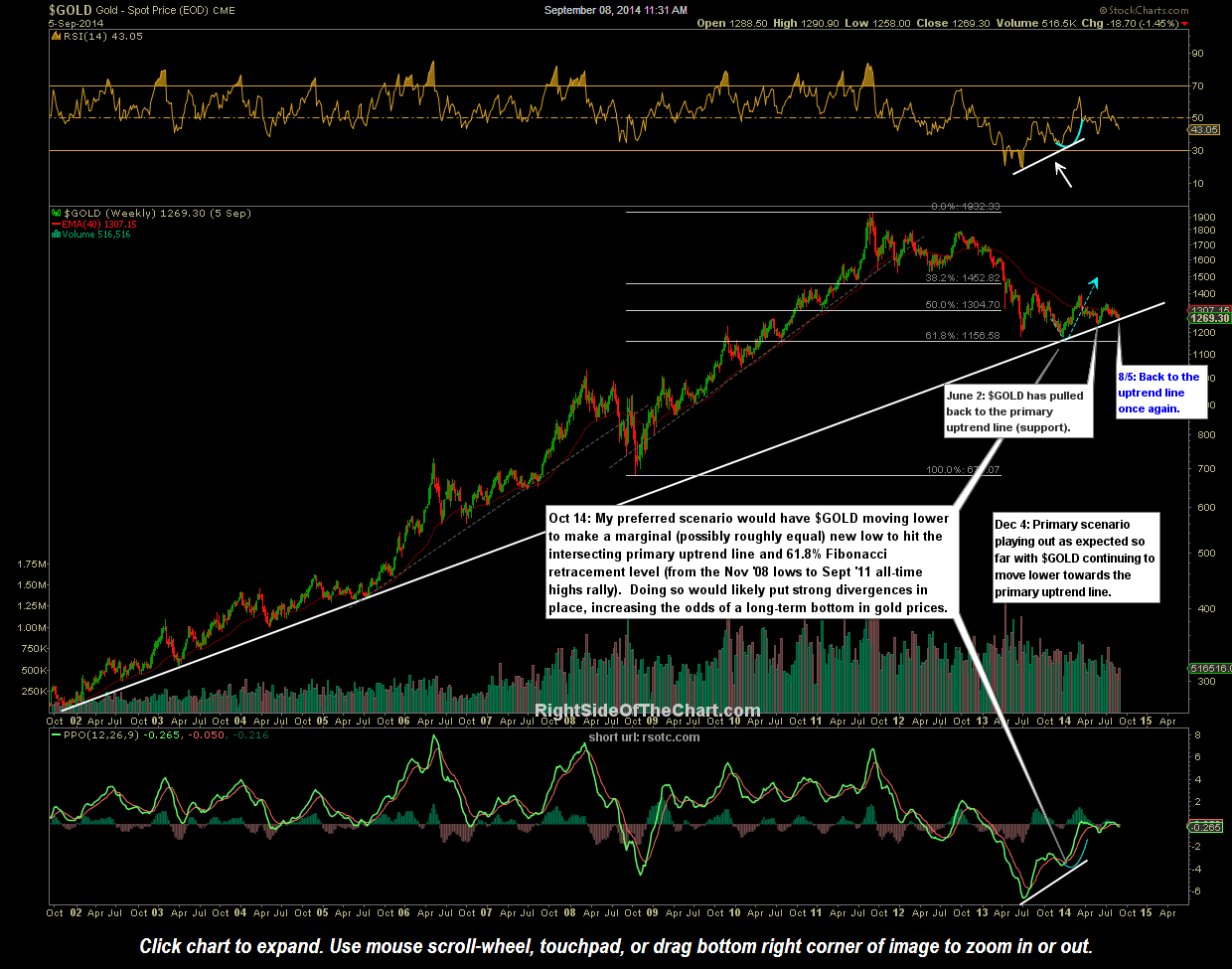

Starting with the longer-term picture for gold & the gold mining stocks, I will be waiting to see how $GOLD (spot gold prices) close out the week as $GOLD closed right on the nearly 13 year long-term uptrend on Friday, a key major support level. As with all weekly charts, it is the end-of-week (Friday) close that matters as intra-week spikes below support are not unusual. As mentioned in the past, should $GOLD make a solid weekly break below this long-term uptrend line, that would open the door for another test of the mid & late 2013 double-bottom lows, the next major support level for gold. A link to the live, annotated weekly chart of $GOLD is available on the Live Charts page and can also be viewed by clicking here.

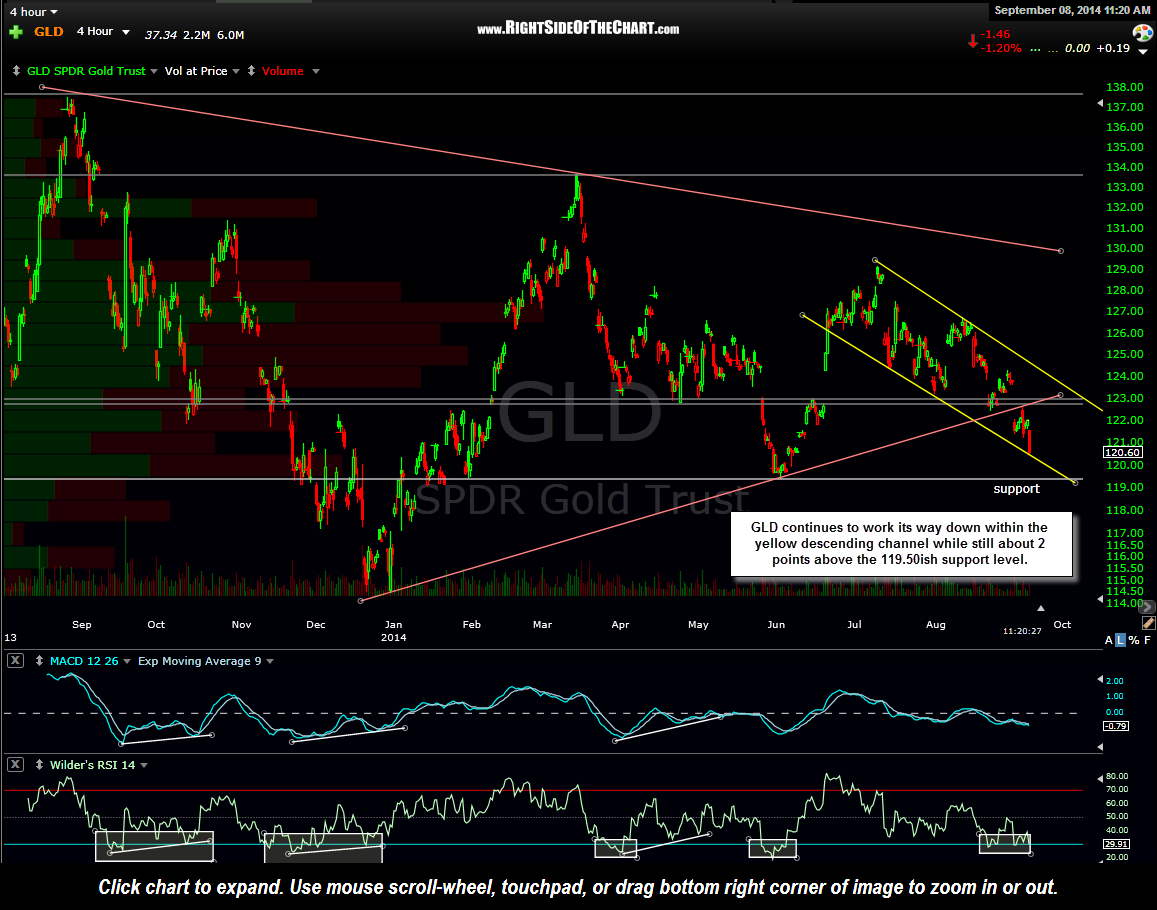

Moving down to the 4-hour period of GLD that I’ve been covering lately, following last Tuesday’s gap below the symmetrical triangle pattern (bearish), followed up by Thursday’s failure upon backtesting the triangle pattern from below (additional bearish confirmation), prices are likely headed towards the aforementioned 119.50ish support area before any significant reversal. Therefore, my best guess for gold prices in the near-term, assuming the longer-term bullish case is still intact, would be to see spot gold prices make an intraweek breakdown of the longer-term uptrend line (on the weekly chart of $GOLD above), only to close back on or above that key support level. Once again, any solid weekly close below would likely bring prices down to test the mid & late 2013 lows in gold in the upcoming weeks or months.

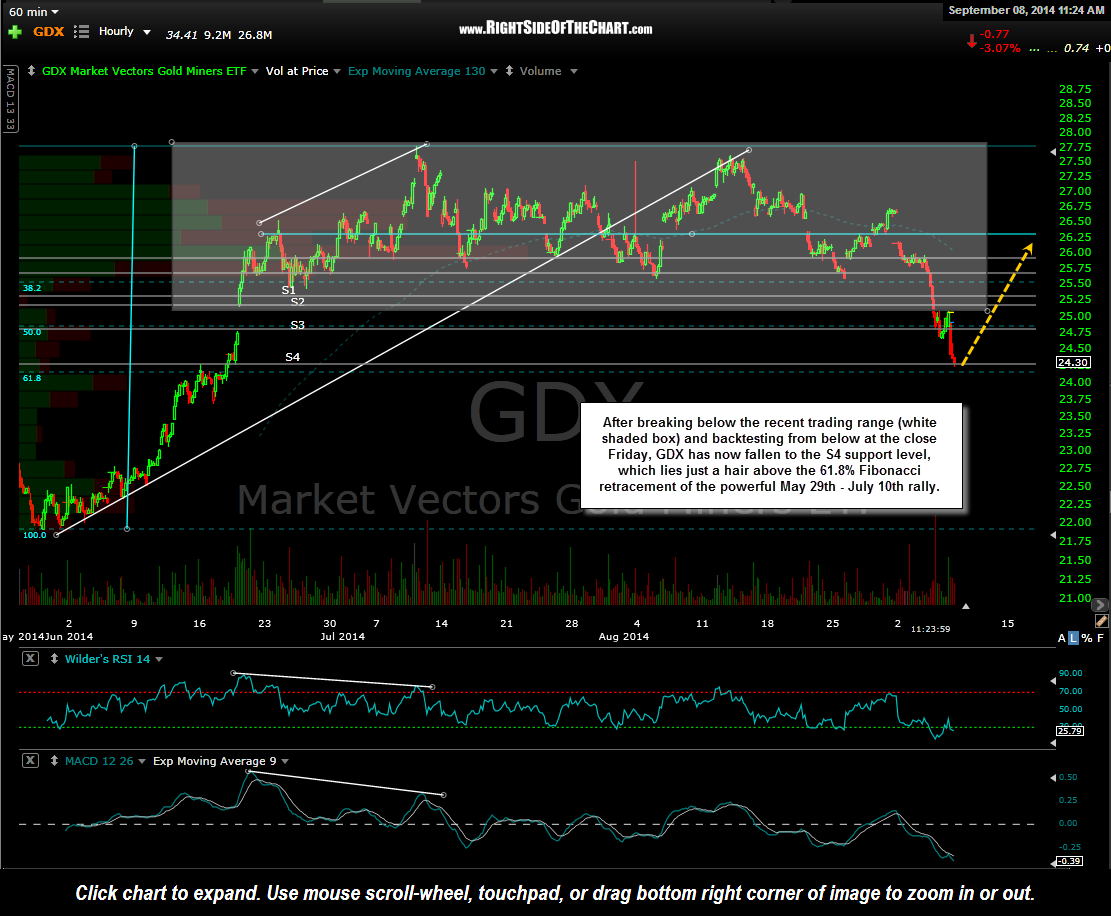

Zooming down to the 60 minute chart of GDX that I have recently been focusing on, GDX has now reached the S4 level which was one of the previously posted likely downside targets for this move as well as the lowest potential reversal level that I had listed. As powerful as this recent correction on GDX has appeared, the S4 support level lies just a hair above the 61.8% Fibonnaci retracement level (a common retracement level) of the even more powerful May 29th- July 10th rally in the gold mining stocks. With another 1% or so downside projected in the metal (GLD), the miners could move somewhat below the 61.8% retracement before bouncing (assuming that GLD does indeed reverse off of the 119.50ish support level) but I also wouldn’t be surprised to see the miners catch support here & start moving higher before gold prices, again, going with the assumption that 1) A new bull market in gold is indeed underway and 2) $GOLD is going to reverse off of the weekly support line. Both of those are still big “ifs” and so I continue to hold tight on my positions for now while waiting to see how both gold & the miners act around these key support level before adding or reducing any exposure to the sector.