In this post on June 21st, I had stated that “the popular XLF (Financial Sector ETF) is also on my radar as one of the more promising swing-short candidates. I haven’t pulled the trigger yet but there are several large financial companies, in fact many of the largest components of the XLF, including banks, credit card companies, insurance companies, & even the almighty BRK-B (Berkshire Hathaway cl.B) that although not ready yet, may be setting up as potentially lucrative swing-short trades.”

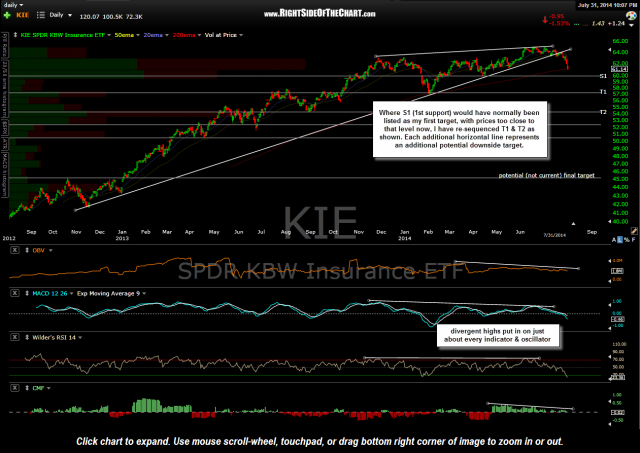

Although the KBW Insurance Index is “only” down about 4 1/2 % in the eight trading sessions since then, in reviewing the charts this evening I continue to reiterate my belief that the financials, including the insurance industry, look to offer some of the most attractive swing short opportunities that I’ve seen in a long while. I’ve only made it about a third of the way through reviewing all of the components of KIE (SPDRs KBW Insurance ETF) tonight but I am truly impressed by not only the quality, but also the sheer quantity of short setups with attractive R/R profiles in addition to relatively large profit potential.

There are so many promising trade ideas that it will take some time to finish reviewing all of the charts in the sector and then culling the list for the most promising short candidates, which I plan to finish by mid-day tomorrow. Although I don’t believe that the chart on KIE looks as bearish as the majority of the charts on the individual components, I figured that I’d pass it along for now.

KIE closed right on the 200 -day EMA today, a level which has done a good job of support & resistance over the past several years so for those inclined to establish a short position in the ETF vs. individual names (which I plan to post soon), it would be prudent to wait for a solid break and/or a likely close below that level before establishing a short entry. Also note that the Nasdaq Composite closed on support today & the S&P 500 close just slightly above its primary uptrend line, a very key support level (see both daily charts under the Live Charts section)… just one more reason to hold off adding much short exposure at this point if you have not already done so. With tomorrow being the end of the week (adding two extra days of “overnight risk”) it might be best to wait until early next week before opening too many new positions although my best guess is that, regardless of what happens tomorrow, things could get ugly next week.

On a final note, from time to time I will post a question that I’ve received, along with my reply, if I think that there might be a take-away or some value for others, or in this case, simply to help shine some light on my trading & investment selection process. My reply to this question that I received today regarding my outlook on gold simply speaks to my views on incorporating fundamental & technical analysis into my trading & investing as well as attempting to filter out a lot of the “noise” that’s out there.

Q: Hey Randy, how much weight do macroeconomic factors provide when making your recommendations?

How will gold hold up with the dollar breaking out to the upside and the Euro heading down (most likely headed for further losses based on the recent deflation fears), the Fed set to end QE in October and raise rates in early 2015 (if not sooner)? Yes, geopolitical issues right now are supporting the safe haven appeal of gold but unless the situations in the Ukraine, Iraq or Israeli/Palestinian elevate to more than local skirmishes this appeal will wear off in the relative near future IMHO.

I realize the miners sometimes move without increases in gold prices as they did in June but can they sustain these gains without gold price increases? I note some of the juniors are reporting earnings this week and they are not good. Many of them are in precarious financial positions already.

I just don’t see how all the world’s central banks will ever allow the price of gold to skyrocket as this would diminish their ability to use their sovereign currencies to control their economies.

A: Although I do take all that stuff in, over the years I’ve learned that the charts are a much more accurate predictor of future prices than are the fundamentals, or at least the information that is disseminated to the general public, like you & I. Not to say that I’m a conspiracy theorist, because for the most part, I am not. It’s more so in the fact that by the time that you hear or read about something, such a geopolitical event or a company’s blow-out quarterly earnings report, that information has already been largely, and in many cases, completely priced into the stock.

Take a company’s earnings, for example. Companies typically release their quarterly earnings results about 1 month after the quarter closes. That means that the data is up to 4 months old at that point. Those in the know (insiders & those they have passed non-public info along to, including friend, family, hedge funds, etc..) have for a large part already bought or sold all the shares on the news that the public assumes is “fresh”. Of course that doesn’t hold true with all stocks, all the time, but I do believe that it happens often enough. Basically, although I do think there is certain value in filtering out & processing what headlines are available to us, assuming that one is proficient in doing so (which the vast majority is not, hence the overall under-performance of the retail investor), I’ve learned to tune most of it out as noise in order to avoid “paralysis by analysis”, which is when a trader or investor just sits aside and passes on opportunity after opportunity because they weren’t confident enough to pull the trigger due to all the conflicting information surrounding the security in question.

I want to be clear that I don’t think that each & every one of the points that you make are not valid, as they most certainly may be as it relates to the future demand for gold. I just wanted to share what drives my own decision making process which again, is almost exclusively driven by the charts for short-term (swing) trades and largely driven by technicals when it comes to my long-term trades/investments although I certain give more consideration to fundamentals when investing longer-term. I hope this helps or at the very least, give you some insight into my personal trading & investing style, which may or may not align with that of other traders and investors.