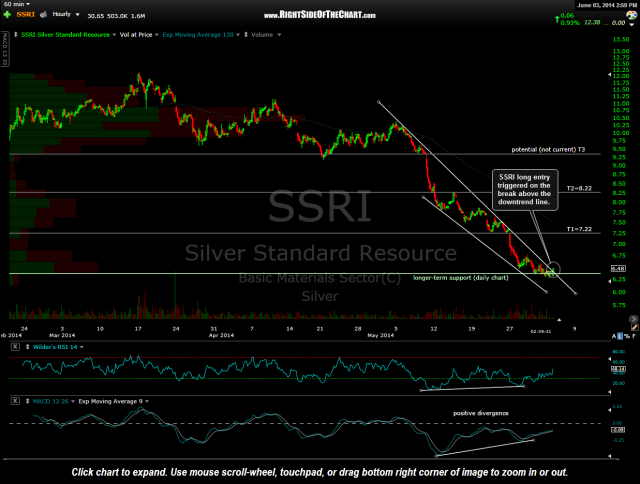

The SSRI (Silver Standard Resources) trade setup posted yesterday has triggered an entry on a break above the downtrend line on the 60 minute time frame. Price targets remain as previously posted (see chart) while suggested stops would be dependent on one’s preferred price target(s), ideally using a R/R of 3:1 or better. For those interested in the above average return potential for this trade but leery of trying to catch a falling knife such as SSRI, a tight stop under yesterday’s low of 6.28 is an option offering minimal downside risk if wrong (barring any large gap down exceeding your stop… always a possibility when holding positions overnight).

As with all long-side breakouts, I’d prefer to see the volume on SSRI running above average (1.5x or better) but with trading volumes running light lately and the previous bullish case made for a reversal in SSRI, this stock has a decent shot at a pop to at least the first target, especially if the stock can rally into the close today & follow-through to the upside tomorrow.