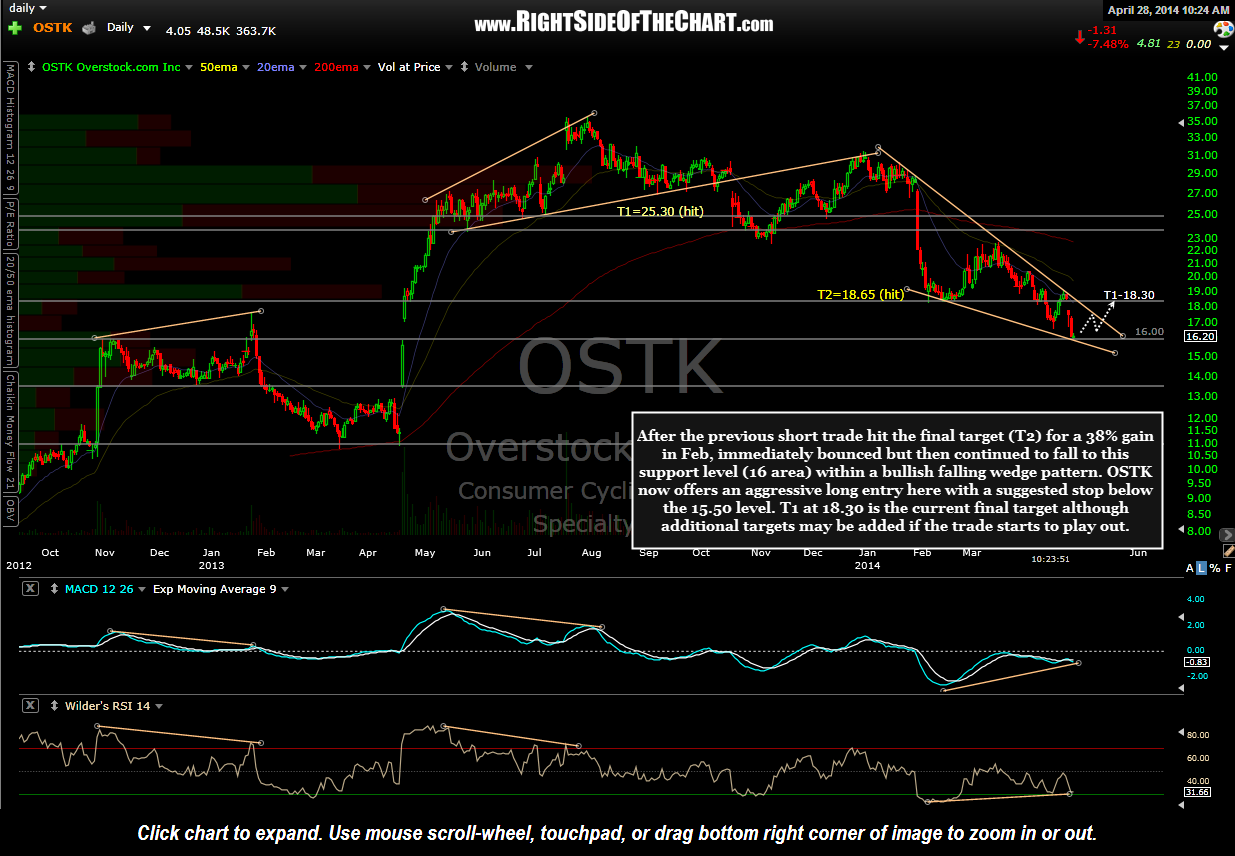

After the previous short trade on OSTK (Overstock.com Inc.) hit the final target (T2) for a 38% gain in Feb, the stock immediately bounced but then continued to fall to this support level (16 area) within a bullish falling wedge pattern. OSTK now offers an aggressive long entry here with a suggested stop below the 15.50 level. T1 at 18.30 is the current final target although additional targets may be added if the trade starts to play out. An alternative, lower-risk entry would be to wait for prices to break above the top of the bullish falling wedge pattern.

My current plan is to take a partial position here, adding on a break above the pattern assuming the chart on OSTK and the broad markets confirm at the time. As to avoid any confusion, my overall bias and positioning remains bearish at this time and I’m taking a long in OSTK as a partial hedge to a net short portfolio as the near-term direction of the market is still a bit unclear. I also strive to post the best looking setups, long or short, regardless of my own personal views on the broad market.