It’s been just over a week since my last update on GDX & the gold mining sector. The gold & silver mining stocks remain on of my favorite longer-term trade ideas for 2014 and the reason for this update is that we may be at or very near the next buy signal in GDX and many of the individual mining stock trade ideas. To quickly summarize: The mining stocks were first mentioned as one of my favorite long-term trade ideas for 2014 back in mid-December as gold was approaching my long-standing downside target. As with the previous bottom in the mining sector back on June 26, 2013, I shared my favorite picks in the sector along with my preference to begin scaling into those select individual miners (or GDX as a proxy). As with the June 26th bottom, which immediately lead to a 40% rally in the sector, the gold stocks have so far launched an impressive rally with the sector up about 17% off the December lows.

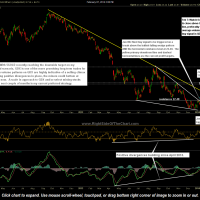

From there, GDX went on to trigger my second buy signal on Jan 13th (a break above the smaller bullish falling wedge pattern AND the 22.40 resistance level), then moving sharply higher to hit my first primary swing target (T1), the primary downtrend line on Jan 24th. At that point, I stated booking partial profits as a pullback & consolidation was likely due to the overbought conditions with prices hitting that key resistance level. The same day that T1 was hit, this post was made outlining my preferred scenario of a pullback to support with the 22.95 area being an objective level to add back long exposure to GDX and the actual support being the top of the gap at 22.85. GDX immediately reversed off the T1 downtrend line falling nearly 6% and went as low as 22.81, a mere 4 cents below that support level. Since hitting T1, GDX has been consolidating in a very tight trading range bounded by the downtrend line on the upside and the top of that Jan 17th gap. I view this as constructive price action as this was exactly the consolidation that was/is needed in order for GDX to make a break & sustained move above the primary downtrend line.

That brings us to today as currently, GDX is trading ever so slightly above the downtrend line. However, there are a couple of things that are lacking for the next buy signal in the sector. First of all, the volume on GDX is tracking below average today. I prefer to see volume of 1.5x or better the 60 – 90 day average on a long-side breakout, especially such a well watched sector and downtrend line as this. Add to that the fact that it’s Friday and only just over an hour left in the trading session (I try to avoid taking late day breakouts heading into the weekend) plus GDX is only slightly above the downtrend line, up “only” 2.85% on the day as I type (a relatively muted move for this very volatile sector). Either way, I will be watching GDX closely next week for any potential upside follow-thru (bullish) or a failed breakout/rejection off this key resistance level (near-term but not necessarily intermediate or long-term bearish). Any follow-thru to the upside, particularly on above average volume, will likely be the catalyst for a relatively quick move to the second target zone (26.30-26.90).