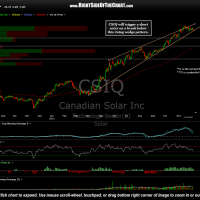

CSIQ (Canadian Solar Inc) will trigger a short entry on a break below this rising wedge pattern. T2 is the current final & preferred target although this trade could be extended to T3 at 10.85, depending on how the charts of CSIQ, TAN (solar sector etf) and the broad markets develop going forward.

CSIQ (Canadian Solar Inc) will trigger a short entry on a break below this rising wedge pattern. T2 is the current final & preferred target although this trade could be extended to T3 at 10.85, depending on how the charts of CSIQ, TAN (solar sector etf) and the broad markets develop going forward.

I also plan to put together a video covering the solar stocks today and possibly some additional videos or written commentaries (with static charts) on the coal sector and growth & income trade ideas, specifically the mREITs (mortgage REITs), some of which still look promising from a longer-term perspective. My commentary on the broad markets remains light as there really haven’t been any new developments lately. The US equity markets continue to make a slow-grind higher despite bearish divergences and extreme sentiment readings that continue to build although most key European markets have recently started moving sharply lower at key technical junctures. Several of those charts can be viewed on the Live Chart Links page.