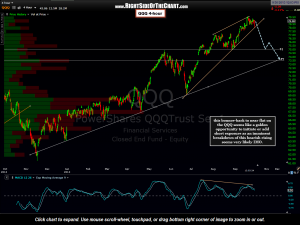

This bounce back to near flat on the QQQ seems like an objective opportunity to initiate or add short exposure as an imminent breakdown of this bearish rising seems very likely IMO. My expectations for the “fireworks” to begin this week far exceeds the ~1%ish gap down in the broad averages today but is more along the lines of a 5%+ drop over the next week or so (and likely then some from there). As such, I am adding QID (2x short Nasdaq 100 tracking etf) as the Q’s have recovered nearly all of this morning’s losses. Personally I just bought some puts on the index but as many traders don’t have the ability, experience or comfort level to trade options, I am adding QID as an Active Trade Idea for shorting the index.

This bounce back to near flat on the QQQ seems like an objective opportunity to initiate or add short exposure as an imminent breakdown of this bearish rising seems very likely IMO. My expectations for the “fireworks” to begin this week far exceeds the ~1%ish gap down in the broad averages today but is more along the lines of a 5%+ drop over the next week or so (and likely then some from there). As such, I am adding QID (2x short Nasdaq 100 tracking etf) as the Q’s have recovered nearly all of this morning’s losses. Personally I just bought some puts on the index but as many traders don’t have the ability, experience or comfort level to trade options, I am adding QID as an Active Trade Idea for shorting the index.

Of course one could directly short QQQ or even one of the leveraged long etf’s, such as QLD (2x long $NDX) or TQQQ (3x long $NDX) although I would personally avoid going long the 3x short $NDX tracking etf, SQQQ, for any trade expected to last more than a day, as in the expected case with this trade. Leveraged ETF’s are prone to price decay over time and that decay increases as a function of both the amount of leverage that a particular etf employs (e.g. 2x or 3x) as well as the number of days the position is held. As such, IF the $NDX were to drop substantially from current levels over the next few days to weeks, it is likely that the TQQQ would drop by more that 3x the amount of the $NDX as a result of the 3x leverage plus the decay. The SQQQ (3x short $NDX) on the other hand, is likely to rise by less that 3x the amount of the drop in the $NDX due to the inherent price decay caused by the leverage. Here’s a 4 hour chart with my current primary scenario on the QQQ with the exact price target levels & possibly some additional targets to follow. As I’m currently leaving some room to add to the position should Q’s continue to move a little higher within the wedge, I have yet to determine a suggested stop level. However, a solid break (or 4 hour close) below the wedge would be the next sell (add-on) trigger at which point I will determine my stops.