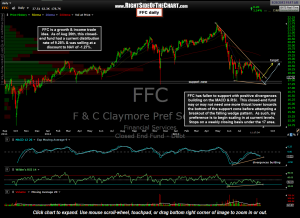

FFC, along with a few other attractive high yielding fund trade ideas, was passed along by a follower of the site (thanks CM). FFC is a growth & income trade idea. It is a CEF (closed-end fund) which invests primarily in preferred securities. As of Aug 26th, this closed-end fund had a current distribution rate of 9.25% & was selling at a discount to NAV of -1.27%. This CEF has fallen to support with positive divergences building on the MACD & RSI. More information on FFC can be viewed by clicking here.

FFC, along with a few other attractive high yielding fund trade ideas, was passed along by a follower of the site (thanks CM). FFC is a growth & income trade idea. It is a CEF (closed-end fund) which invests primarily in preferred securities. As of Aug 26th, this closed-end fund had a current distribution rate of 9.25% & was selling at a discount to NAV of -1.27%. This CEF has fallen to support with positive divergences building on the MACD & RSI. More information on FFC can be viewed by clicking here.

From the look of the chart, FFC may or may not need one more thrust lower towards the bottom of the support zone before attempting a breakout of the falling wedge pattern. As such, my preference is to begin scaling in at current levels, continuing to add to the position periodically whether prices move higher from here (taking it to a full position once/if prices break above the downtrend line) or adding down to around the 17.25ish area, should the stock continue to move lower from current levels. Suggested stops on a weekly closing basis under the 17 area.