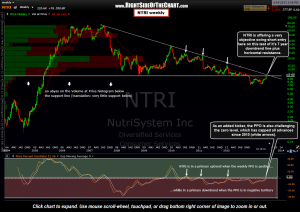

NTRI was good for a 19.4% gain when the first target was hit back in April. Since then, the stock has bounced sharply, reaching extreme overbought readings on the daily chart as well as approaching overbought levels on the weekly chart. Those overbought readings, more importantly combined with the fact that the stock has run into dual-resistance levels defined by NTRI’s 7-year primary downtrend line plus a key horizontal resistance level, provide an objective swing-short entry on the stock at current levels. New targets & stops TBD soon. To account for the increased volatility and relatively large profit targets & stop, a suggested position sizing of 0.60- 0.75 (60-75% average position size) might be considered.

NTRI was good for a 19.4% gain when the first target was hit back in April. Since then, the stock has bounced sharply, reaching extreme overbought readings on the daily chart as well as approaching overbought levels on the weekly chart. Those overbought readings, more importantly combined with the fact that the stock has run into dual-resistance levels defined by NTRI’s 7-year primary downtrend line plus a key horizontal resistance level, provide an objective swing-short entry on the stock at current levels. New targets & stops TBD soon. To account for the increased volatility and relatively large profit targets & stop, a suggested position sizing of 0.60- 0.75 (60-75% average position size) might be considered.