I had a couple of requests for updates on XLU (utilities sector ETF) as well as update requests on IWM & LIT.

XLU went on to break below the uptrend line (& backtested it) with 2 reactions off S1 (1st support level) so far & the next sell signal to come on a solid break below it. Previous (Sept 26th, although XLU was likely covered in videos since) & updated daily charts below. Bottom line: No change in the technical posture nor my outlook at this time…. just need S1 to clearly get taken out to open the door to the deeper targets.

IWM next short-term sell signal to come on a break below this latest minor uptrend line with a more powerful longer-term sell signal to come on a solid break and/or daily close below this larger uptrend line + 226.70ish support on the daily chart below.

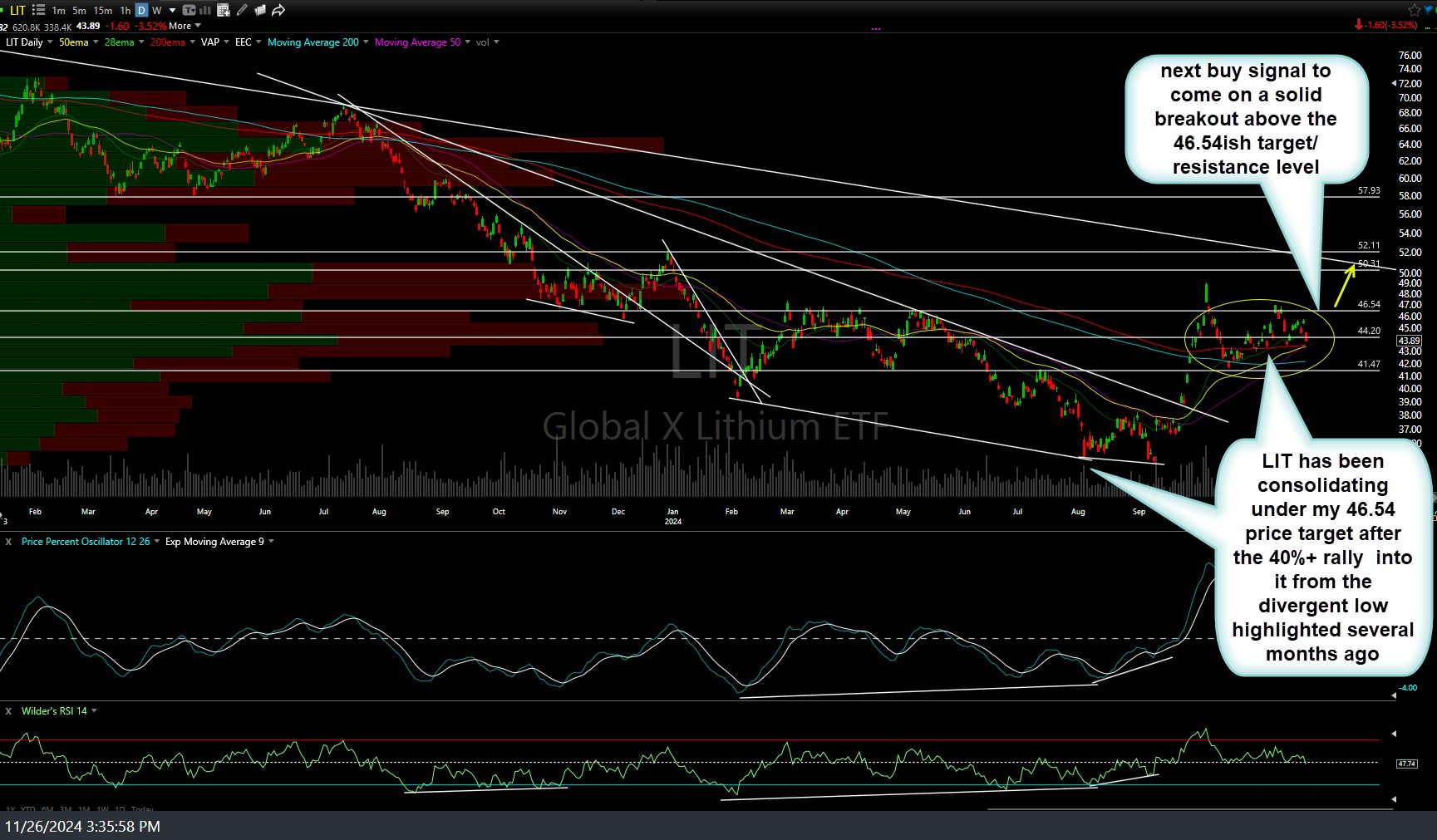

LIT (Lithium sector ETF) has been consolidating under my 46.54 price target after the 40%+ rally into it from the divergent low highlighted several months ago. Previous (June 28th) & updated daily charts below. (LIT & the individual lithium stocks were also covered in one or more videos since the previous chart was posted).