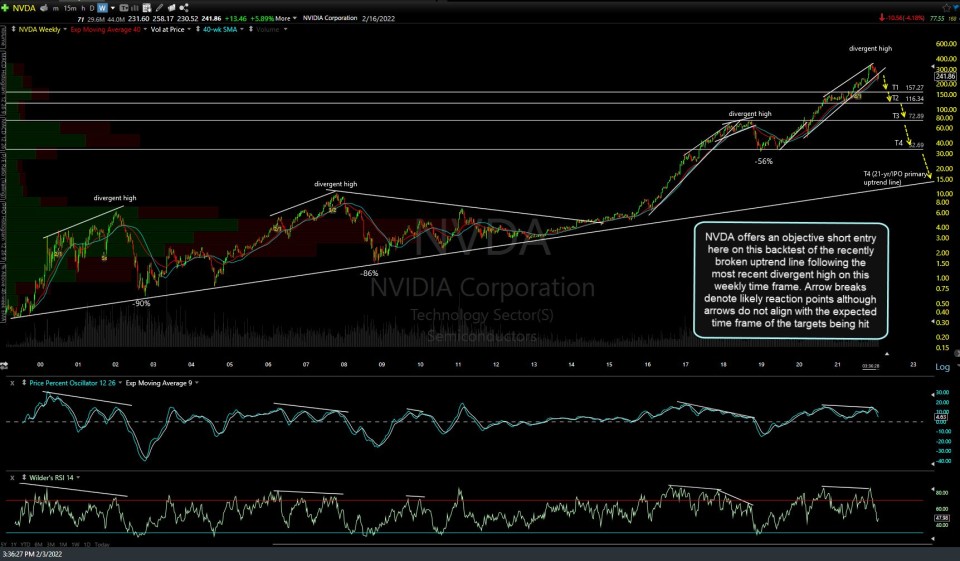

NVDA (NVIDIA Corp) offers an objective short entry here on this backtest of the recently broken uptrend line following the most recent divergent high on this weekly time frame. Arrow breaks denote likely reaction points although the arrows do not align with the expected time frame of the targets being hit.

Suggested stops would be in line with one’s preferred price target(s), ideally using an R/R of 3:1 or better. With the first target nearly 40% below current levels (150-160ish support zone), the minimum suggested stop would be around 13%. As with the previously posted TSM trade setup, I’m focusing on the long-game (i.e.- longer-term swing or trend trading) vs. the short-game (typical swing trading in which the duration of the trades are typically measured in days, weeks, or just a few months). Should the semis go on to hit any or all of my long-term targets, that would likely be a matter of weeks for the initial targets & months or even years for the lower targets with several opportunities to reverse from short to long to game counter-trend bounces if/as those targets are hit and IF the charts confirm at that time.