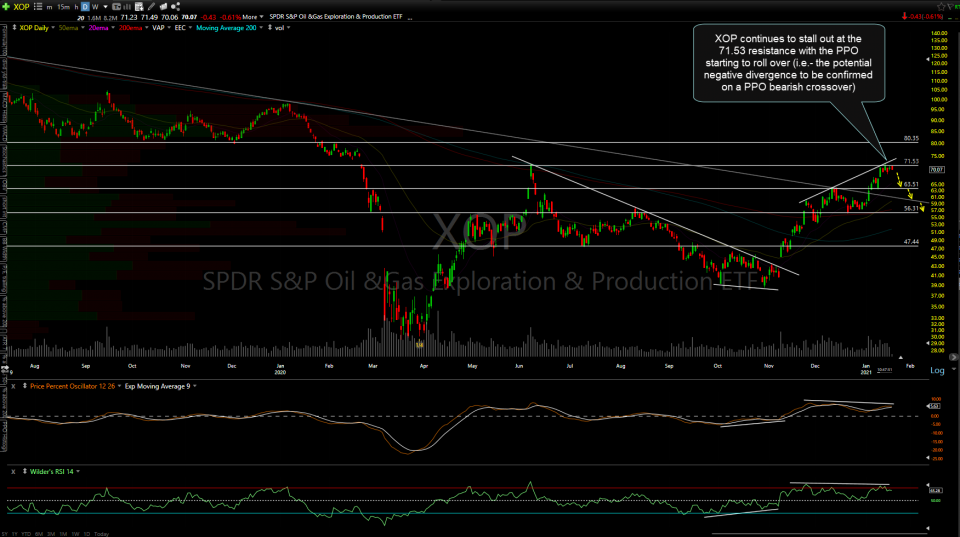

Despite today’s rally in broad market ($SPX) and tech-heavy Nasdaq 100, XOP (Oil & Gas Exploration & Production ETF) continues to stall out at the 71.53 resistance with the PPO starting to roll over (i.e.- the potential negative divergence to be confirmed on a PPO bearish crossover).

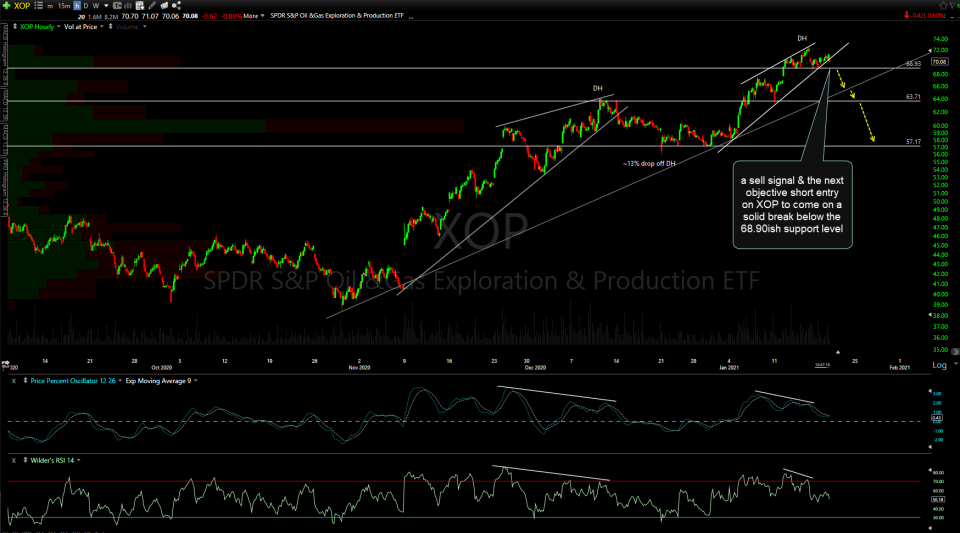

A sell signal & the next objective short entry (following last week’s rally into resistance) on XOP to come on a solid break below the 68.90ish support level with potential swing targets on the 60-minute chart below.

Likewise, DRIP (3x bearish/inverse Oil & Gas E&P ETF) still offers an objective short entry based on the fact XOP is overbought at resistance with potential divergences on the daily time frame with the next buy signal to come if/when XOP breaks below that 68.90ish support level mentioned above.