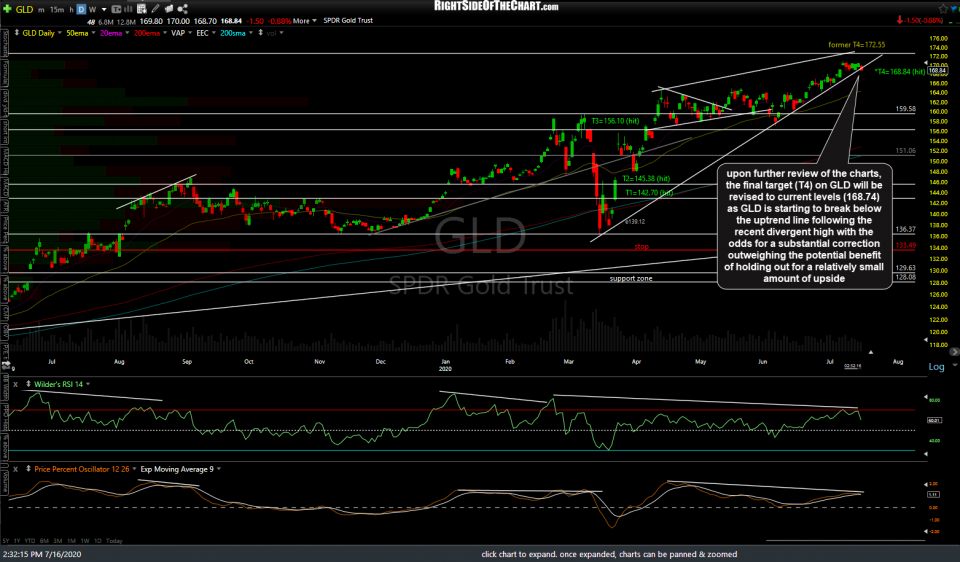

Upon further review of the charts, the final target (T4) on GLD will be revised to current levels (168.74) as GLD is starting to dip slightly below the uptrend line following the recent divergent high with the odds for a substantial correction outweighing the potential benefit of holding out for a relatively small amount of upside. This provides a 21.4% gain on the trade from the entry price of 139.12 back on March 16th, exactly 4 months ago today. Consider booking partial or full profits and/or raising stops, if holding out for additional gains. Original & updated daily charts below.

As it appears that the odds for a significant correction in gold, silver, and the related mining stocks continue to rise, I will follow up with video coverage of the precious metals, miners, & related ETFs as potential short trade ideas (with objective entry points, price targets, etc..) as well as highlighting objective levels for long-term swing traders, trend traders, & investors to consider raising stops and/or adding to any long-term position(s) in the metals & miners on a pullback. As this is the final target for both the GLD official Swing Trade idea as well as the Long-term Trade idea, GLD will now be moved from the Active Trades categories to the Completed Trades archives along with all related posts for this trade.