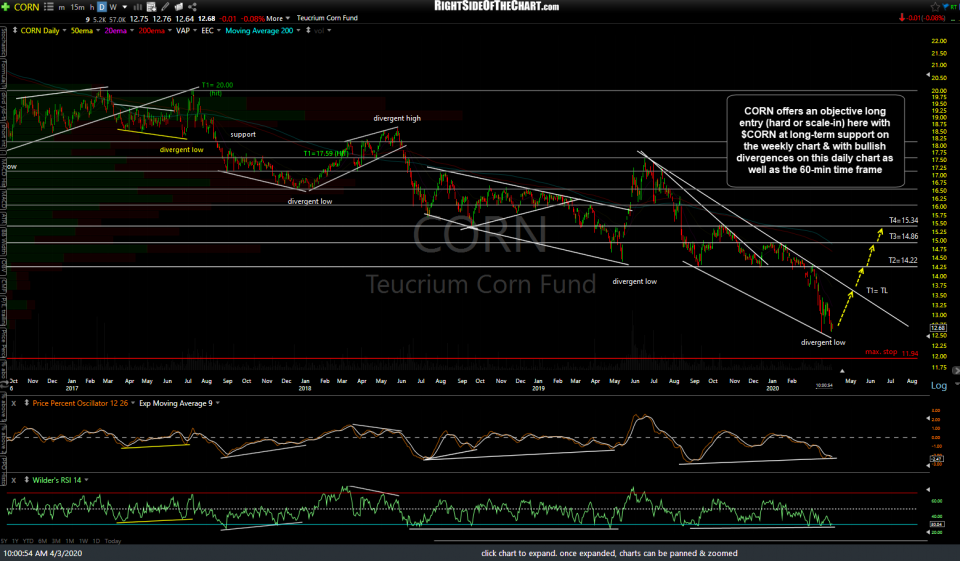

CORN (Corn ETN) offers an objective long entry (hard entry/full position or starter/scale-in) here with $CORN at long-term support on the weekly chart & with bullish divergences on this daily chart as well as the 60-min time frame and will be added as an Active Long Swing Trade as well as a Long-Term Trade idea. Daily chart below.

The price targets for this trade are T1 at the downtrend line (which is a dynamic value, i.e.- the exact price depending on if & when CORN rallies to touch it from below), T2 at 14.22 (a high-probability target & my current preferred target), T3 at 14.86, & T4 at 15.34. The maximum suggested stop is 11.94 (consider a tighter stop if only targeting T1 or T2) and the suggested beta-adjusted position size is 1.0.

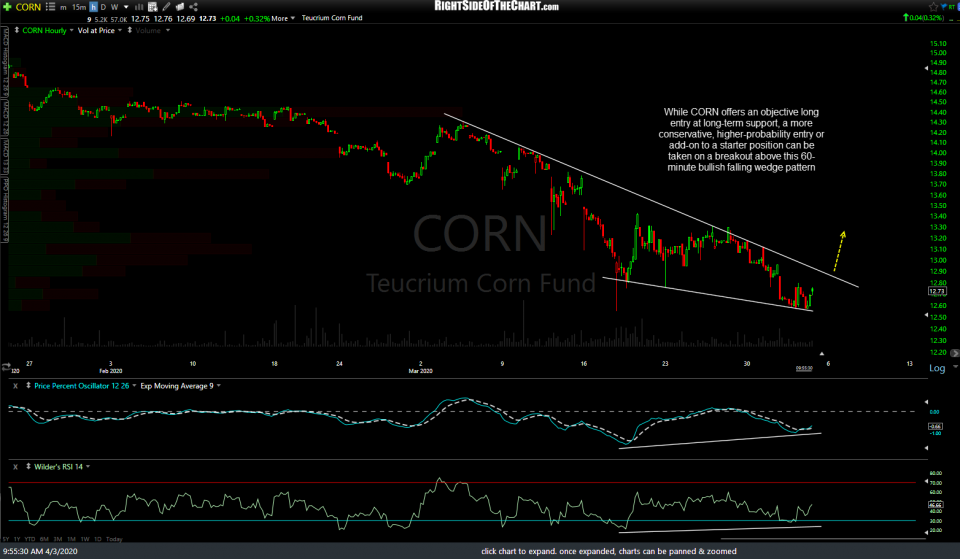

While CORN offers an objective long entry at long-term support, a more conservative, higher-probability entry or add-on to a starter position can be taken on a breakout above this 60-minute bullish falling wedge pattern above. Likewise, /ZC corn futures will trigger a buy signal on a break above this 60-minute downtrend line on the chart below.

Zooming out to the long-term weekly chart of $CORN (corn futures), the case for either a hard or soft entry on corn can be made as $CORN has once again fallen to the key long-term support level around 334 with the RSI at the first oversold reading since 2014 (note the previous rallies in $CORN that followed the previous oversold readings over the past 15+ years.