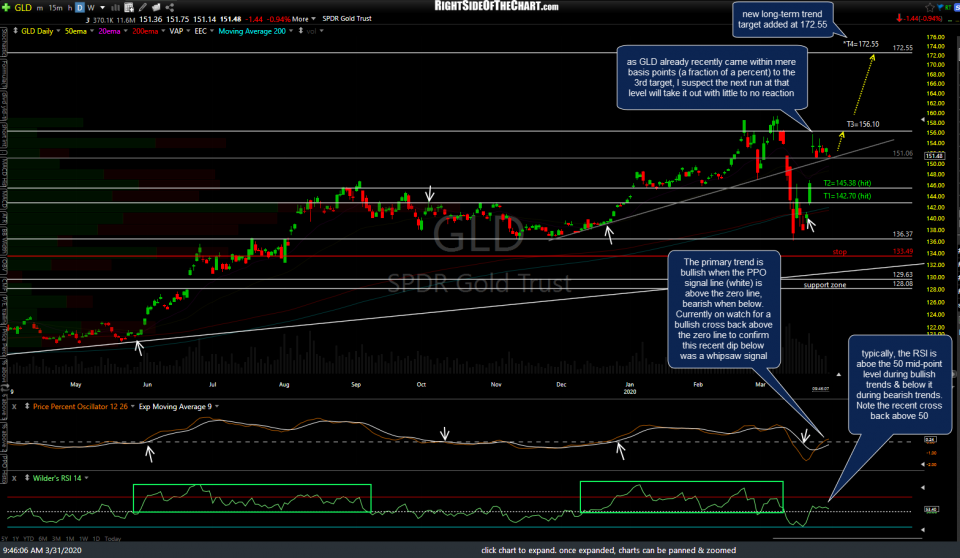

Based on further review of the charts & as previously mentioned as a likelihood, I have decided to add an additional longer-term swing/trend target on the GLD (gold ETF) Active Long Swing Trade + Long-term Trade Idea. The new target is T4 at 172.55, set just below the long-term trend target of 173.22 that I’ve been highlighting over the past year or so.

Currently, GLD has been experiencing the typical and expected reaction, via a consolidation following the brief momentum-fueled overshoot of my 151.18 long-term price target, rallying over 32% since the backtest & objective entry or add-on highlighted back in early 2019 on the first weekly chart below, followed by the updated weekly chart.

- GLD weekly April 17th

- GLD weekly March 31st

Zooming down to the near-term outlook for gold, /GC (gold futures) is currently trading just above the 1616ish support following a brief momentum-fueled overshoot, thereby offering an objective entry or add-on with the next objective entry/add-on to come on a break above the downtrend line on this 60-minute chart.

The breakout above the larger descending price channel in /DX (US Dollar futures) was the catalyst for this recent rally in the $USD although /DX now offers an objective short entry here at the 100.012 resistance level with a stop somewhat above. The next objective short entry & sell signal will come on a break below the bottom of this minor price channel & if/when that happens, that should provide a tailwind for the GLD long trade.