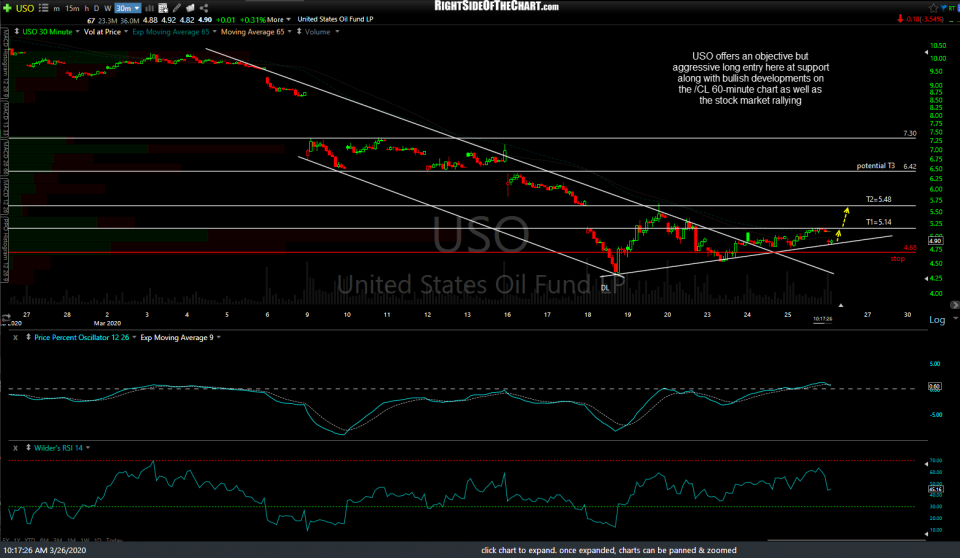

USO (crude oil ETN) offers an objective but aggressive long entry here at uptrend line support along with potential bullish developments on the /CL 60-minute chart as well as the stock market rallying.

The price targets for this trade are T1 at 5.14 and T2 at 5.48 with the potential for a third target to be added around the 6.40 level. The suggested stop for this trade is 4.68 and the suggested beta-adjusted position size is 0.80.

/CL (crude futures) is pinched between the 23.11ish & downtrend line resistance in a descending triangle pattern that is likely to break to the upside if the stock market continues to rally today. As such, it offers an objective, yet aggressive long entry here with a stop just below 23.00 or a more conventional, less aggressive entry on a solid breakout above the trendline. Ditto for USO (wait for a breakout above this downtrend line in /CL for a more conventional, higher-probability entry). 60-minute chart above.