After rallying over 25% since the mid-October divergent low, /KC coffee futures have put in the latest divergent high which increased the odds for another pullback with a near-term sell signal to come on a break below the bearish rising wedge whether or not we get one more thrust up within the wedge. The first chart below is the 60-minute chart posted back on Oct 14th highlighting the objective entry on that divergent low followed by this morning’s updated 60-minute chart.

- KC 60m Oct 14th

- KC 60mNov 26th

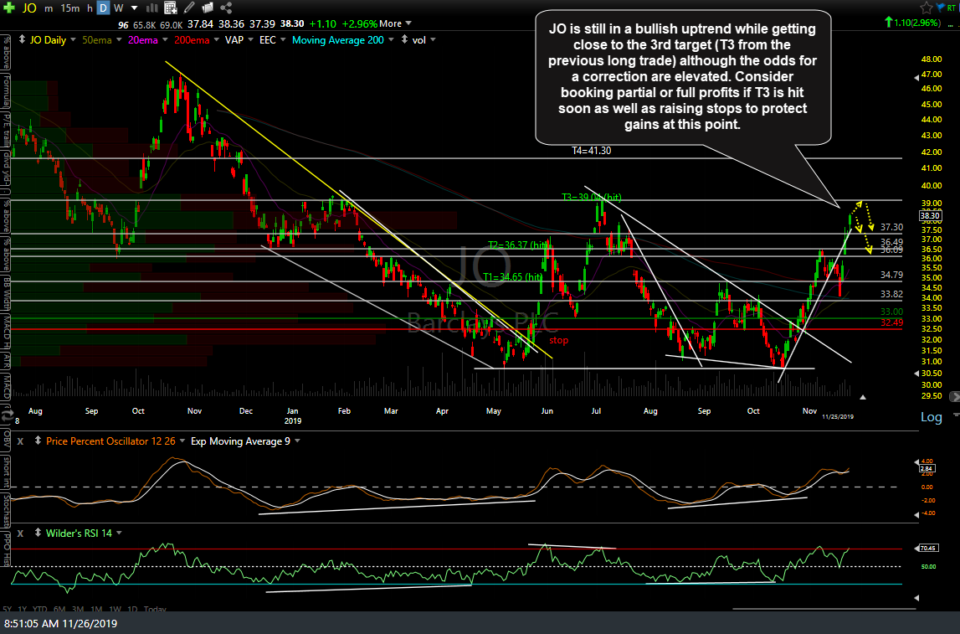

Likewise, JO (coffee ETN) is still in a bullish uptrend while getting close to the 3rd target (T3 from the previous long trade) although the odds for a correction are elevated. Consider booking partial or full profits if T3 is hit soon as well as raising stops to protect gains at this point. October 28th & updated daily chart as of yesterday’s close below.

- JO daily Oct 28th close

- JO daily Nov 25th close