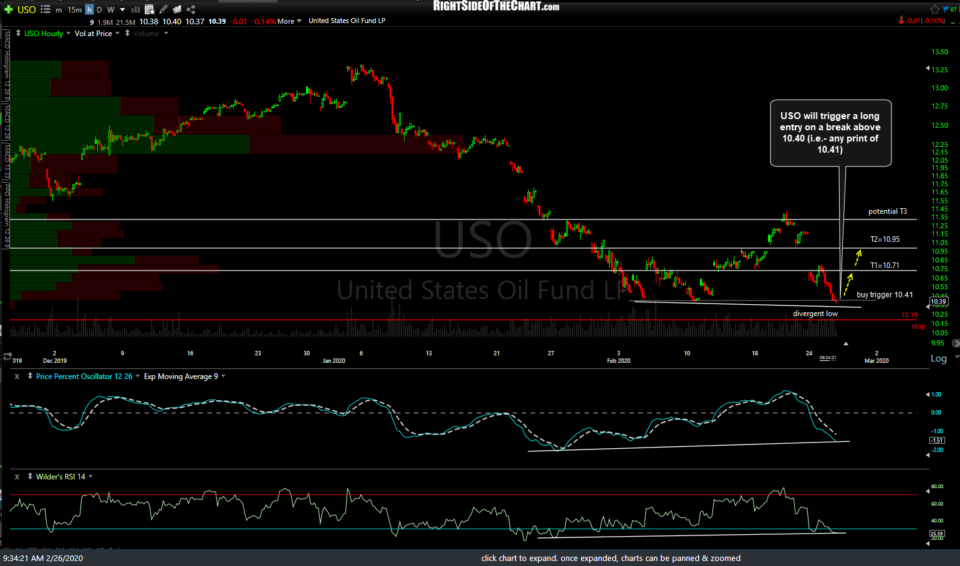

The USO (crude ETN) swing trade entered earlier today on a break above 10.40 has hit the suggested stop of 10.19 for a total loss of 2.1% or a 1.9% beta-adjusted loss (based on the 0.90 position size). Previous & updated 60-minute charts below.

- USO 60m Feb 26th

- USO 60m 2 Feb 26th

With QQQ & SPY reversing off the first bounce targets, the pullback in the equity market dragged oil down with it although as of now (less than 30-minutes to the close) the Nasdaq 100 is still holding above yesterday’s low so the case for a rally up to the next targets around 224 on QQQ & 320.50 SPY are still potentially in play.

Should those targets be hit this week or next, then the bullish divergences that are still intact on USO & /CL will most likely play out for a tradable rally. As such, USO is on watch for another potential official long trade & those that took the trade & are giving it a little more room on their stops, it still looks fine at this time IMO.

Regarding this trade, I will take shots on counter-trend trades like this: Stocks, indexes or commodities falling to support (the previous reaction lows on USO, in this case) while oversold with bullish divergences all day long, as those at the type of trades that are poised for very fast & strong short-covering rallies. The key is to keep stops relatively tight on these types of “catch a bottom” trades so I am fine taking a 2% loss on trades with a quick 8-11% upside potential, such as USO or /CL have from here (should the stock market hold up & both USO & /CL take out those near-term downtrend lines on the intraday charts). Of course, to each his (or her) own so pass on trade ideas that don’t mesh with your particular trading style, risk tolerance or outlook for that particular security.