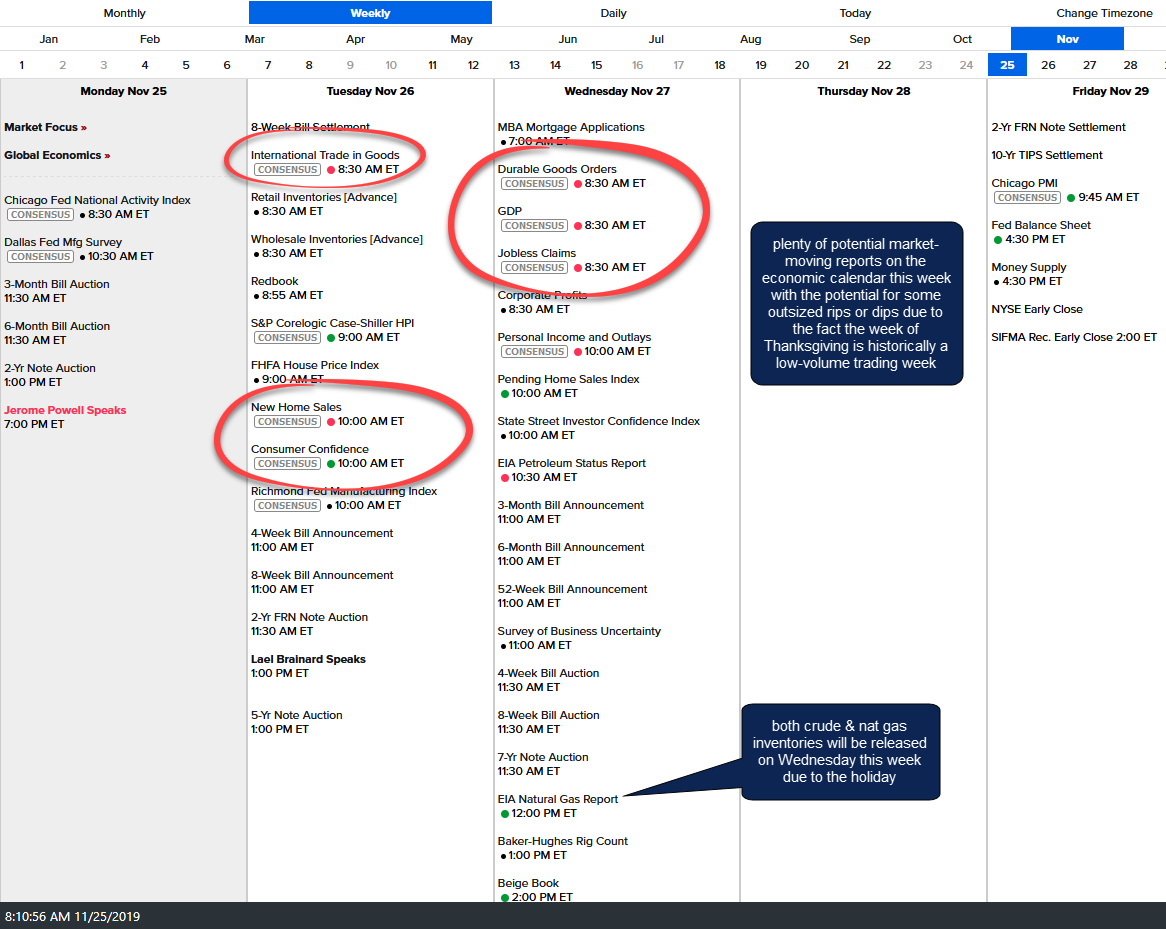

I really don’t see many charts that stand out as compelling regarding the major stock indices & other asset classes such as precious metals, commodities, oil & nat gas, etc… so in lieu of the usual Charts I’m Watching, I figured that it is worth pointing out some of the potentially market-moving reports on the economic calendar this week.

The week of the Thanksgiving holiday in the US is typically marked by low volume as many traders take time off for and around the holiday. The US markets will be closed on Thursday followed by an abbreviated trading session (1 pm EST close) on Friday. Low volume trading days have the potential for causing larger-than-usual price swings, especially on market-moving news or headlines that might trigger a flood or buy or sell orders. Of particular note this week is the trio of reports scheduled for 8:30 on Wednesday: Durable Goods, GDP & Jobless Claims.

While this week could just end of being more of the same with the low-volume, low-volatility grind that we have seen over the past several weeks, my preference has always been to keep things light during the week of Thanksgiving meaning that I will often pass on taking new positions & may allow a little more room on my stops for existing swing positions as false breakouts/whipsaws and stop-raids are more common around the low-volume holiday sessions such as the week of Thanksgiving & Christmas.

I’d like to spend some time this week to finish updating the Trade Ideas categories by re-assigning any of the previous Active Trades that have already hit their final target or maximum stop to the Completed Trades archives. I’m also going to spend some time catching up on any questions or chart requests within the trading room. As always, if I see any compelling trading opportunities I will pass those on asap.