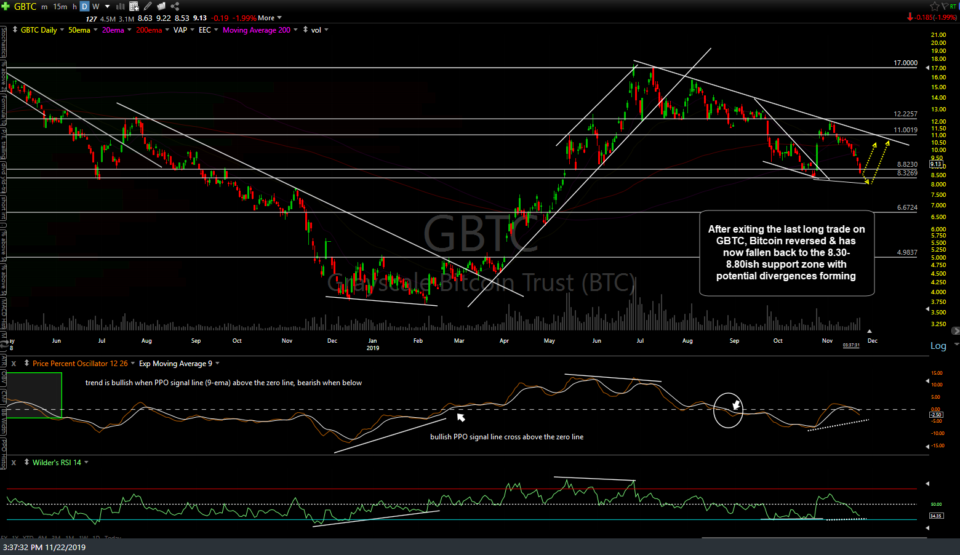

After exiting the last long trade on GBTC for a 27% profit, Bitcoin reversed & has now fallen back to the 8.30-8.80ish support zone with potential divergences forming on the daily chart. As I usually prefer to hold off on taking new positions in the final trading hours on a Friday, with 2 extra days of overnight risk (although I did just take a small starter position), I’ll wait to see how GBTC (Grayscale Bitcoin Trust) and /BRR (Bitcoin futures) trades next week before deciding whether or not to add it as another official swing trade again. If so, the trade parameters (entry trigge/buy points, price target(s), suggested stop & position size adjustment, etc..) will follow. Until then, I just wanted to pass along these charts for those interested.

/BRR (Bitcoin futures) is hammering off the 6979 support today with potential bullish divergences building on daily time frame as well with a minimum target of the downtrend line likely, should it hold support & start to rally from here.