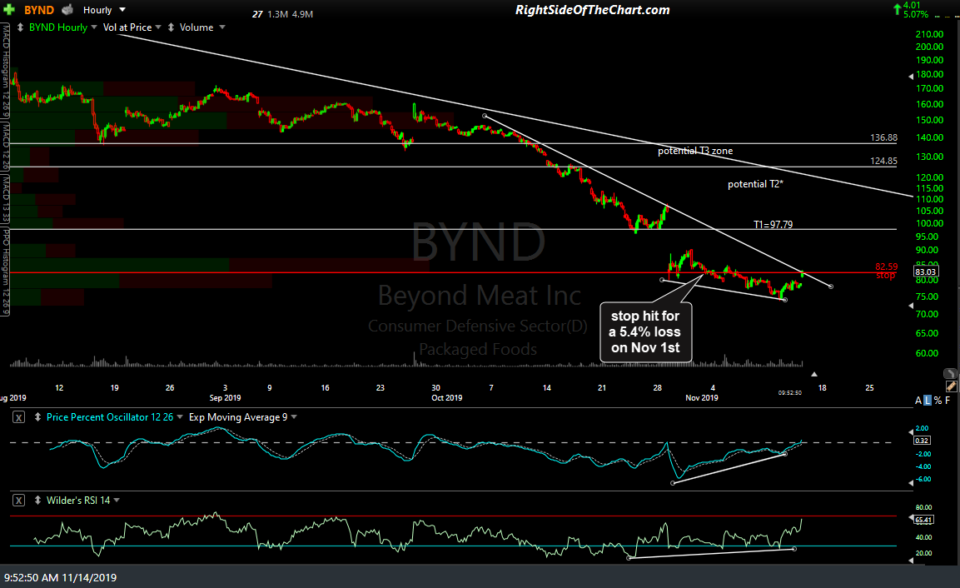

The recent BYND (Beyond Meat) Long Swing Trade hit the suggested stop of 82.59 on November 1st for a 5.4% loss.

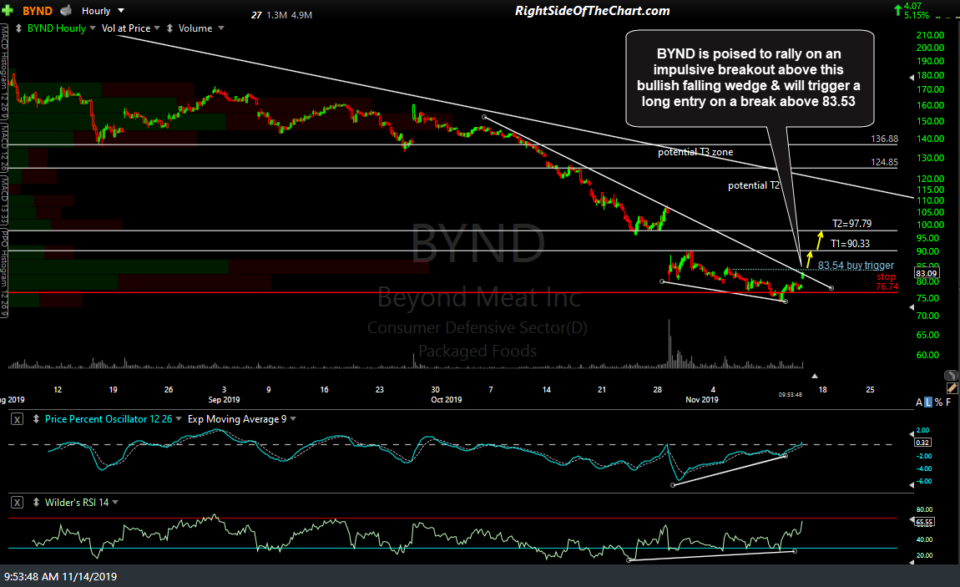

Since that trade was stopped out, BYND continued to drift lower within a bullish falling wedge pattern on the 60-minute time frame with positive divergences confirming the bullish nature of the wedge pattern. As such, BYND will be added as a new Long Swing Trade Setup with an entry to be triggered on any move above 83.53, ideally on 1.5x or better average volume, which would help to confirm a breakout.

The price targets for this trade are T1 at 90.33 and T2 at 97.79 with the potential for additional targets to be added, assuming that an entry is triggered and depending on how the charts develop going forward. The maximum suggested stop for this trade is 76.74 with a suggested beta-adjusted position size of 0.90.