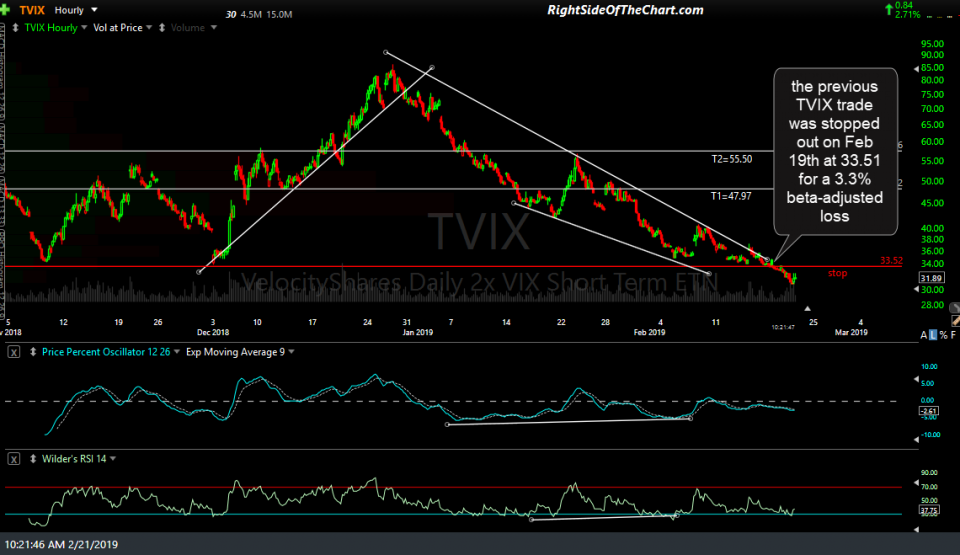

The recent TVIX Long Swing Trade hit the suggested stop of any move below 33.52 on Feb 19th, stoped out at 33.51 for a 3.3% beta-adjusted loss (9.6% total loss x the 0.35 beta-adjustment to account for the 300% leverage). While that trade will be moved to the Complete Trades category soon, TVIX will also be added as a new Trade Setup with an entry TBD based on an convicing breakdown of the recently highlighted bearish rising wedge pattern on the S&P 500 E-mini futures (/ES).

As the $VIX & TVIX don’t always (inversely) mirror the moves in the equity markets, I’d much rather use confirmation of a breakdown in the major stock indexes as the entry trigger for a long on TVIX than a breakout of any key level on TVIX, such as this downtrend line off the Dec highs. I will post a front page update as soon as breakdown occurs and looks convincing. I’d rather give it the benefit of the doubt this time around, as the uptrend has been unusually resilient but I do believe that despite the recent string of failures on bets against the broad market, the risk/reward ratio this TVIX long setup, as well as some of the index & sector ETFs potential short setups, looks extremely favorable.

Personally, I’m fine taking a string of relatively small (3%+/-) losses on attempted trades on the same position as long as the R/R seems compelling and the change for a double-digit gain on that trade seems likely. Of course, there are no guarantees this or any trade will pan out so as always, DYODD and pass on trades that do not mesh with your outlook for that position as well as your risk tolerance & trading style (i.e.- are you comfortable with counter-trend trades or prefer to stick with only trades that align with the current trend).

While I cannot provide individual investment advice, I can say that I believe that it is imperative to identify your loss potential before you take a position and to account for any leverage or above average volatility on a trade. The new RSOTC Trade Position Size Calculator can help with that.

Again, the entry trigger on this trade will be communicated if & when a convincing breakdown occurs in the /ES futures. The price targets for this trade are T1 at 34.90, T2 at 39.78 & T3 at 45.64 (note, the price targets have been revised since the previous trade). The suggested stop will most likely be 30.40 although that may be revised based on the entry price. The suggested beta-adjusted position size for this trade is once again 0.35. (i.e.- approximately 1/3rd a typical swing trade position size).