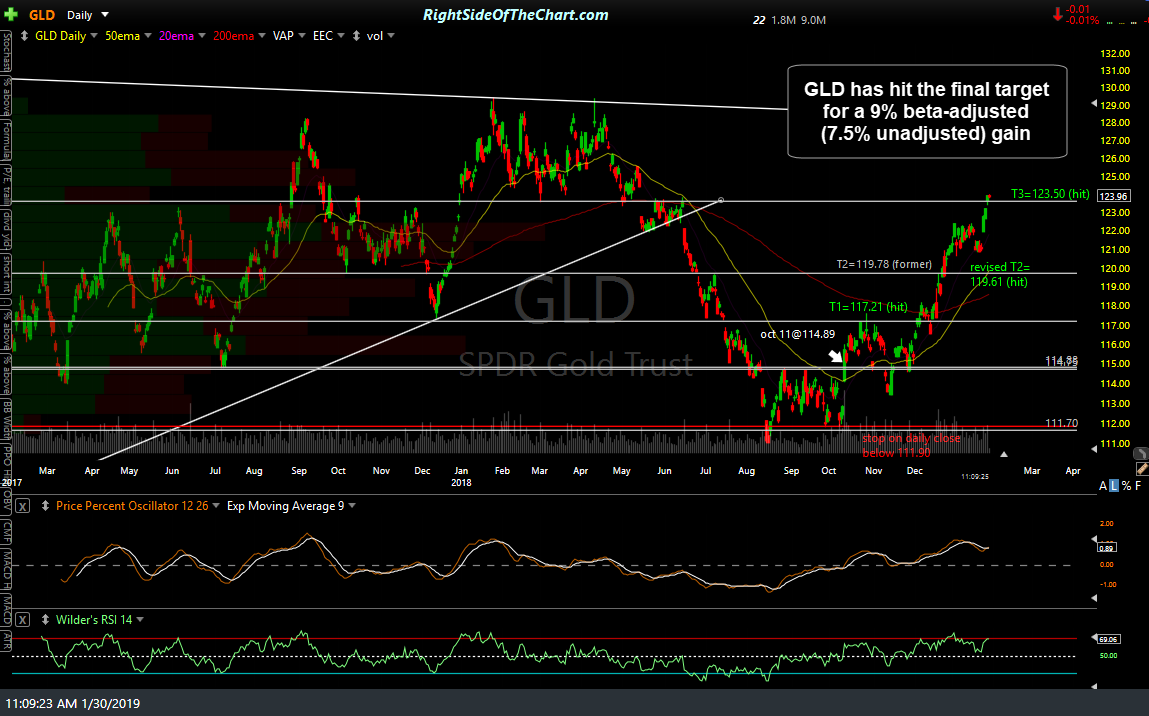

The GLD (Gold ETF) Long-term/Trend Trade has hit the final price target, T3 at 123.50, resulting in a net profit of 7.5% from the entry price of 114.89 on October 11th and a 9% beta-adjusted gain when factoring in the beta-adjusted position size of 1.2 (i.e.- a 20% overweighted position). Original & updated daily charts below.

- GLD daily Oct 11th

- GLD daily Jan 30th

I plan to follow up with analysis on gold along with the other precious metals & miners soon but with gold now trading at a significant resistance level while overbought with some negative divergences forming on the momentum indicators, the chances of a pullback and/or consolidation around this level are elevated at this time. I remain bullish on the longer-term outlook for gold & as such, long-term trend traders & investors might opt to sit tight & ride out any counter-trend pullbacks while raising or keeping their stops in place at this time.

GLD along with all posts associated with this trade will now be moved to the Completed Trades archives where they will be accessible indefinite for future reference. Gold will also be on watch for another potential long entry on a pullback but I do not have any desire to short it at this time.