RKDA (Arcadia Biosciences Inc.) will trigger a long entry on a break above 3.80, ideally on 1.5x or higher above-average volume. The price targets T1 at 4.63, T2 at 5.34 & T3 at 6.18. The maximum suggested stop for this trade is any move below 3.20 while a higher stop should be considered if only targeting T1. Due to the aggressive nature & potentially high-volatility of this trade as well as the above average gain & loss potential, the suggested beta-adjusted position size is 0.70 or lower, depending on one’s risk tolerance & even then, one should pass on this potential trade if it does not mesh with their trading style, objectives & risk-tolerance.

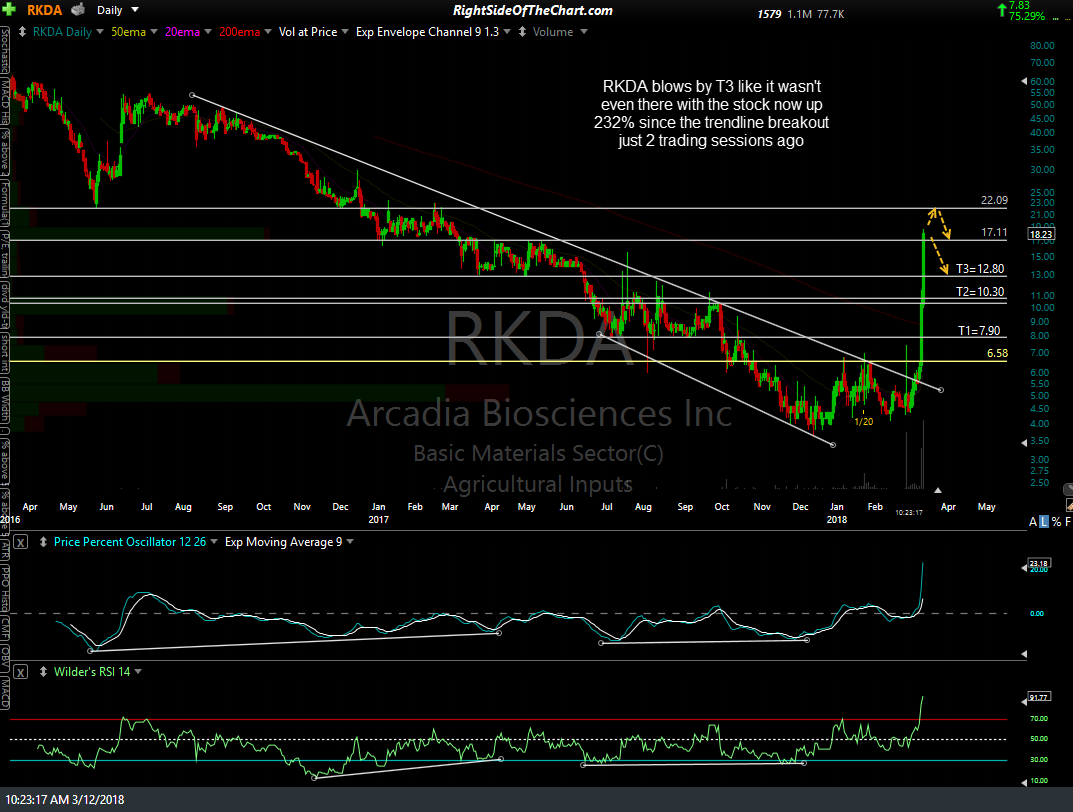

RKDA has been trending lower for years but the stock has a history of explosive rallies within that larger bearish trend, such as the 1430% surge in just a two week period last year, with that breakout identified in advance back on around this time last year (first chart below posted back on Jan 26, 2018, just before the breakout):

- RKDA daily Jan 26th

- RKDA daily March 12th

Just a reminder that a trade setup is not the same as an Active Trade. A trade setup is a stock or ETF setting up in a bullish or bearish chart pattern or technical posture, awaiting a buy signal which typically comes on a break above a well-defined resistance level (or below support for a short trade). No breakout, no trade. Also keep in mind that Arcadia is prone to whipsaw signals, hence my preferrence to see above average volume on any breakout soon although for tracking purposes, RKDA will become an Active Trade on any break above 3.80

Also, note that there are several related stocks in the Agricutural Input sector in addition to RKDA that look compelling as potential long trades. I may publish a video covering the stocks that stand out in that sector and possibly add one or more additional official trades. As such, keep that in mind with your position sizing if you plan to add additional exposure to the ag input sector.