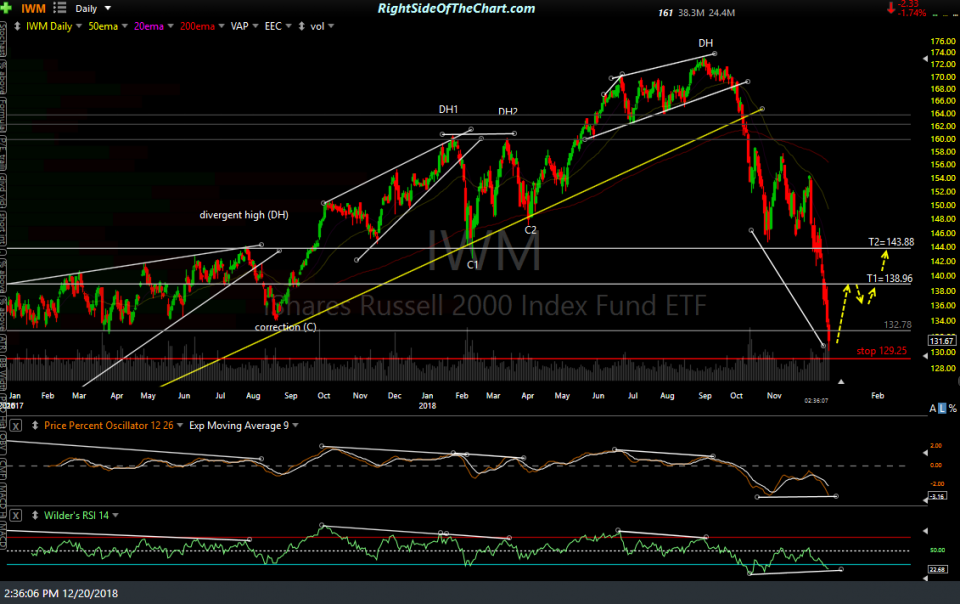

IWM (Russell 2000 Small Cap Index ETF) offers an objective long entry on what appears to be a momentum fueled overshoot of key support on the daily chart while deeply oversold with potential bullish divergences forming on the PPO & RSI. As such, IWM will be added as an official long swing trade around current levels. The price targets are T1 at 138.96 and T2 at 143.88. The maximum suggested stop (if targeting T2) is any move below 129.25 (typo corrected) with a suggested beta-adjusted position size for this trade of 1.0.

As with the QQQ active long swing trade, this should be considered an aggressive, “catch-a-falling-knife” trade & as such, one should pass if that does not mesh with their own unique risk tolerance, trading style, objectives & outlook for the stock market. As with the QQQ swing trade, a more conservative option for those looking to start adding some long exposure in anticipation of the next rally would be to take a starter position of a fraction lot here while scaling into a position of IWM over the next 3-7 trading sessions.

If my take on the market is correct, the market is either at or very close to a tradable bottom or we are on the verge of a final capitulation waterfall-type selloff that would likely cause a sharp but relatively swift flush out move down below the key supports that the major indices are trading at, followed by a sharp reversal & rally. While anything, including an outright market crash is always a possibility, if my primary scenario (we are at or very near a bottom) or alternative scenario (another ~3% washout move down) it appears that the R/R at this time favors going long vs. short.